Forget About the Unemployment Rate, Wages Steal the Show Nowadays

As my colleague Eric mentioned in his forex blog article, the market was expecting a lot of activity in the USD pairs today. Well, there is activity in the forex market but it is going against the Buck, which seems very strange after taking a quick glance at the US employment report that was published a while ago.

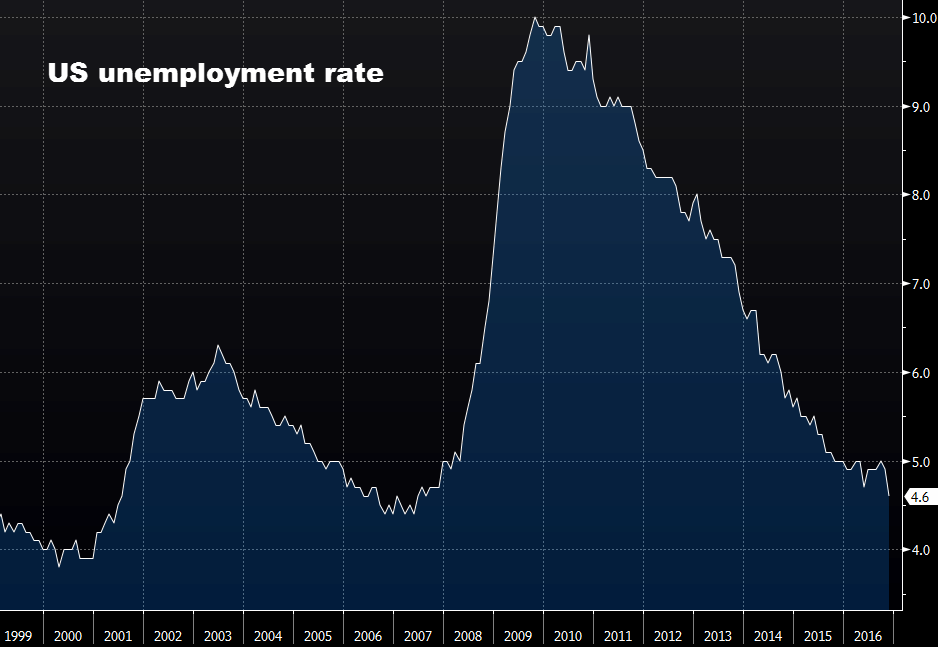

New jobs accounted for nearly 180k payrolls in November and the US unemployment rate fell from 4.9% to 4.6%. That´s the lowest US unemployment level in about a decade, so that must be great right? It is another positive (not great) indicator showing that the US economy is moving forward and I´m pretty sure the headlines tomorrow in the US media will be praising the US economy tomorrow morning.

US unemployment rate is heading for 2007 lows

US unemployment rate is heading for 2007 lows

Yet, the knee jerk reaction in the market was to dump the USD. The USD buyers put up a fight after the knee jerk move was over, but the USD sellers are lurking back again. When did the market start to completely ignore a 3 point decline in the unemployment rate? Even worse, why the hell is the Buck getting hammered?

Only one piece of this report explains it all, average earnings. The wages (earnings) were expected to go up by 0.2% in November but they got slashed by 0.1%. Nothing puts you off more than a wage cut. The yearly earnings numbers moved lower too, from 2.8% previously to 2.5%.

That´s not a good sign at all. New jobs are being created and the unemployment keeps falling, yet the earnings continue to lag. This is worrisome for the FED because this means that the new jobs being created are crap jobs with minimum wage in the retail service industry. Many economists and financial analysts are starting to think that the US economy can´t create quality jobs, thus leaving the current workforce powerless to negotiate wage hikes with their employers.

That´s really not a good indicator and we must keep this in mind next year because if the wages remain weak then the FED might get cold feet and back off from rate hikes. Still, looking at the bright side, the trend in the US average earnings chart is still up, so let´s wait for December´s employment report. Meanwhile, I´m crossing my fingers that today´s numbers send the Buck tumbling further, where I can sell tonnes of GBP/USD and EUR/USD. The 1.28 and 1.08 resistance levels spring back to mind.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account