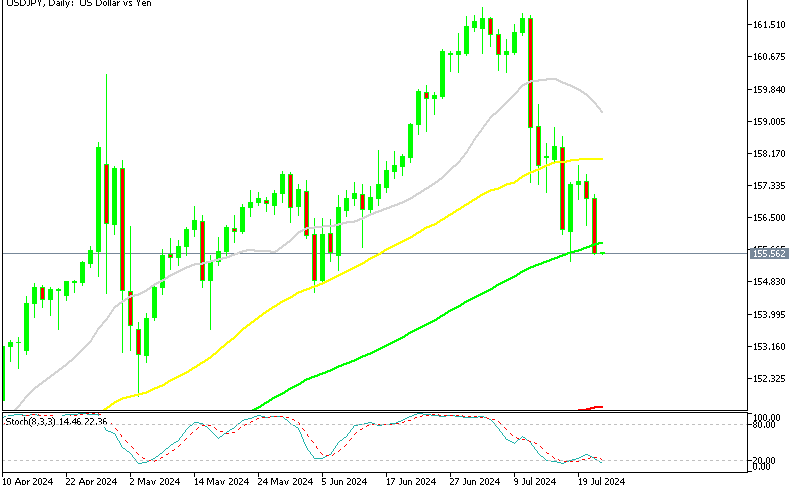

As we mentioned in our first market update earlier today, USD/JPY has been in a short term downtrend in the last few trading sessions leading to the BOJ (Bank of Japan) meeting this morning. In fact, that´s a correction of the larger USD/JPY uptrend that has been forming since Trump won the US elections.

It looks like forex traders were squaring up some of the USD/JPY buy positions which they have opened further down, just in case the BOJ delivered some sort of surprise to USD/JPY bulls. These sorts of moves are frequent during such occasions, but once the forex event is over, the traders go back where they were before that. So, the BOJ meeting ended and USD/JPY buyers got back in business.

As you can see from the USD/JPY chart above, this forex pair is now about 150 pips higher from where it was last night and it´s eyeing last week´s highs, which come around 118.60s. This is a very bullish signal because it means that everyone is bullish biased, since this forex pair surged 150 pips as soon as the BOJ disappeared from the scene. Too bad we stayed out and didn´t open a long term buy forex signal in this pair.

The dips are getting shallower, which means buyers are growing impatient when it comes to buying

The dips are getting shallower, which means buyers are growing impatient when it comes to buying

There was no hesitation to jump on the northbound train and this is the strongest signal showing that the forex market is leaning on one side only, north. That´s what the price action is telling us so we can´t ignore or deny it. It´s similar to the 25 cent tumble from 1.25 during the first half of this year. The market wants to go in one direction, so better not get in the way.

But unlike the first half of 2016, now the fundamental analysis point to the same direction as the technical analysis and price action, which makes the picture even more bullish. Morgan Stanley are already calling for 1.30, highlighting the differences in the fundamentals for both economies. I don´t know if or how quickly we might get up there, but the analysis points up, whatever angle you might like to look from. So, the direction is clear and we´ll come up with the support and resistance levels shortly to see if we might find a spot to open a forex trade.