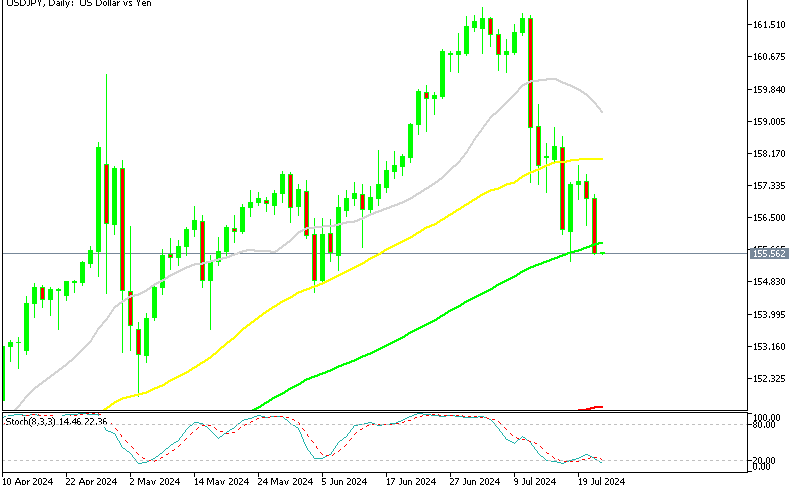

The price action in most forex pairs has been muted this morning, but today is the first day of the week so let´s take a look at what´s happened since the Tokyo trading session started last evening.

As you can see from the USD/JPY chart below, this forex pair has extended its upward move it started on Friday after the US average hourly earnings (wages/salaries) rose more than expected. It reached as far up as 117.53, but it has been making a retrace in the last several hours to 117.

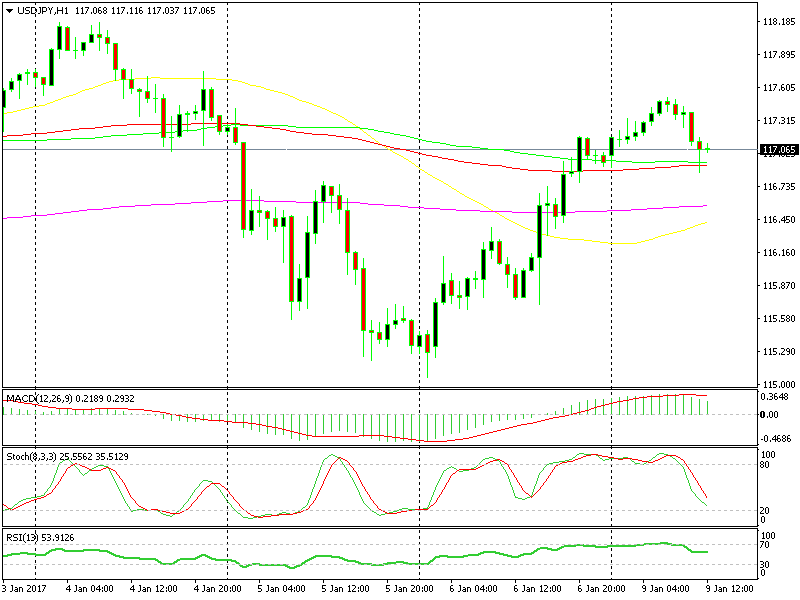

The stochastic indicator is almost oversold

The stochastic indicator is almost oversold

This retrace is presenting forex traders with a buying opportunity around this level. The trend is your friend, right? Well, the intraday trend is strong and it is been pointing up since Friday morning. From that time, the retraces have been very shallow with sellers meeting the buyers on every attempt.

During these last few trading sessions, they couldn´t even take the stochastic indicator to oversold levels on the H1 forex chart, before USD/JPY buyers jumped in and reversed the move. That shows how strong the trend is, and being almost oversold on the H1 chart is a very strong signal.

The moving averages are another technical indicator/signal which points up. The price is having difficulties breaking below these technical indicators in the H1 and 15-minute chart, so the 117 area seems to be providing some decent support.

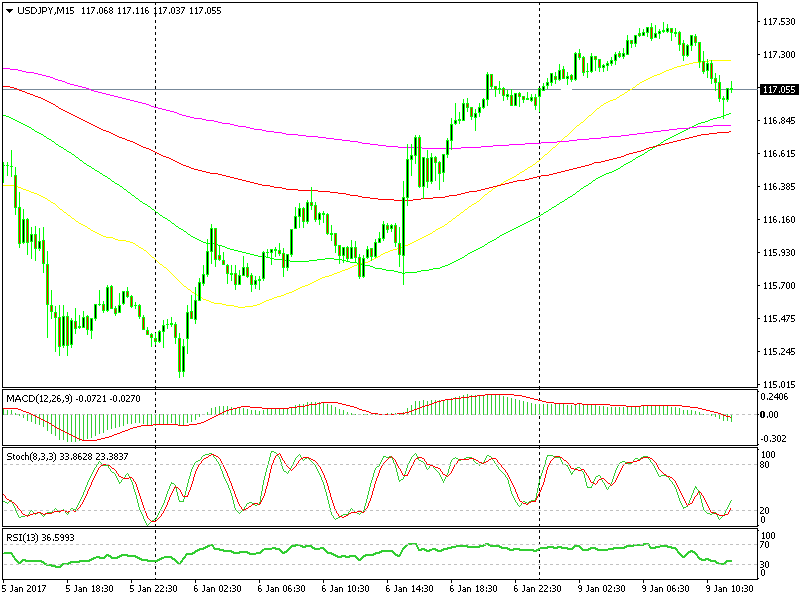

The 15-minute chart setup is very bullish

The 15-minute chart setup is very bullish

Don´t forget that there´s always a 20-30 pip range close to round levels, so the .80 and .20 are usually the reversing points, rather than the round number itself, although that counts as the main support/resistance level. So, a quick dip to 116.80s and a quick reverse is a buy signal.

Besides, the stochastic indicator is almost oversold for the first time since this latest uptrend started on Thursday night/Friday evening, That makes at least three technical indicators pointing up, so are you buying this pair now for a short term forex trade?

We might do so in a moment since I´ve been itching to do so before I started writing this update. But even if we don´t, you can decide to trade this on your own. After all, forex signals are trade ideas too, you´re not obliged to follow them. The retrace might as well stretch lower, but this is the technical forex strategy we base our trades on and it is clearly pointing up, at least for a short term forex trade.