Is the Correlation Between Oil and CAD Over?

The US crude oil inventories data posted a nice jump a while ago. It came out 11 million barrels higher than expected, at 13.8 million barrels.

The Canadian Dollar has been closely correlated to oil prices for quite a long time, but today´s jump in oil inventories wasn´t matched by USD/CAD. In fact, the Loonie barely moved.

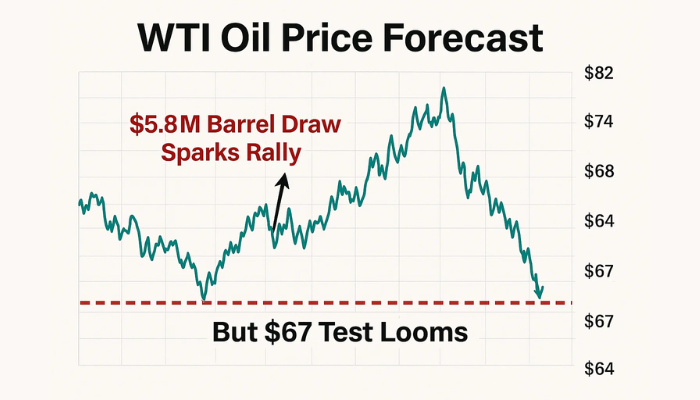

Actually, oil jumped more than a cent after the release, both Brent (UK oil) and WTI (US oil) but no reaction from the CAD.

We must keep an eye on oil prices and the Canadian Dollar in the coming days to see whether this was just a one off or the correlation is lost for real. I don´t think such a close and long term correlation can go out of the window just like that, but I´ll keep an eye on oil prices and the Loonie in the next fe days or weeks.

By the way, we opened a forex signal in AUD/USD a while ago. This forex pair reached the 100 SMA on the H1 chart which we have mentioned quite a few times in the past few trading sessions.

The price pierced that moving average for a few minutes, but it plunged back down shortly after. We´re about 10 pips in profit at the moment with both stochastic and RSI indicators already overbought and heading down. So, it looks good right now.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account