WTI Crude Oil- Let’s Catch the Retracement

What an exciting start of the week! Our gold signal just matured in profit, helping us achieve around 40 green pips in the Asian trading session. We intend to share more signals not only on the forex currency pairs, but also in the commodity market.

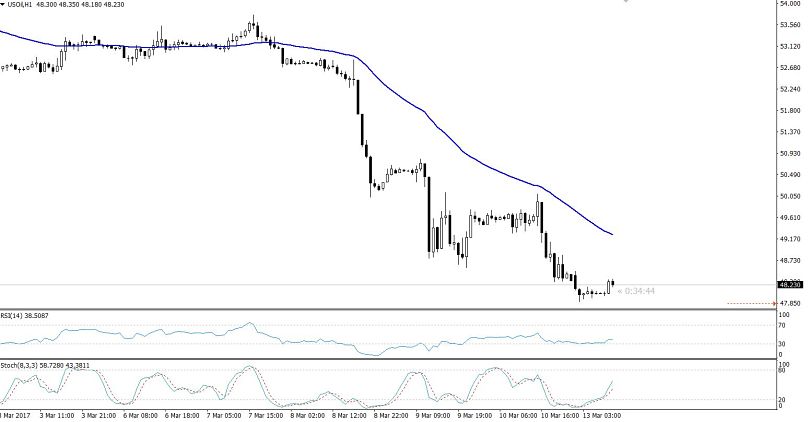

At the moment, I am looking at the WTI crude oil that’s trading lower at $48.180. It has maintained a bearish momentum for 6 consecutive trading days now, dropping to the lowest level within the last 3 months.

The oil prices have failed to rise despite the strong efforts by the OPEC and Non-OPEC oil producers, including Russia. Last year, they reached an agreement to control the production by almost 1.8 million barrels per day (bpd) in the first half of 2017. However, they have failed in it, and in my opinion, the major reason for that is the global economic slowdown.

Technically, the crude oil is trading in the oversold territory as the RSI is holding below 30 in the 4-hour time frame. Moreover, the 50 periods EMA is pushing it deeper. Nevertheless, I am looking to capture a slight retracement at the 38.2% Fibonacci level of $48.75.

Crude Oil Trading Signal: Investors are recommended to have a buying position only above $48 with a stop loss at $47.75 and a take profit at $48.75.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account