Bullish Turnaround For Aussie After Trump Night

Trump broke some more electoral promises yesterday evening. Central bankers who support rate hikes in order to weaken the currency are considered doves. Anyone with the who is against currency devaluation is considered a hawk. Trump was very much against currency devaluation all throughout his campaign which made him a hawk.

But yesterday he turned dovish when he said that he likes the low rate policy, he likes Yellen (wink, wink) and that he won´t label China a currency manipulator.

His statement came as a gift to the commodity currencies, particularly to the Aussie which was going though some rough times.

Apart from Trump and Yellen, another love story has been going on between China and the AUD. However with China and the AUD it is more like a long term relationship, unlike Trump-Yellen which is just simple flirtation.

If the Chinese economy does well, the Australian economy also does well since most Australian exports go to China to support the manufacturing there. Consequently, the AUD also performs well because there is a demand for it amongst Chinese importers.

So, if Trump leaves China alone to do whatever it wants to with Yuan, the Chinese economy will be just a tad better off, the demand for Australian raw material will be a tad higher and the Aussie relatively stronger, hence the jump in AUID/USD last night.

This has shifted the market sentiment towards the AUD, form bearish to bullish, at least in the short term, until the Trump effect wears off.

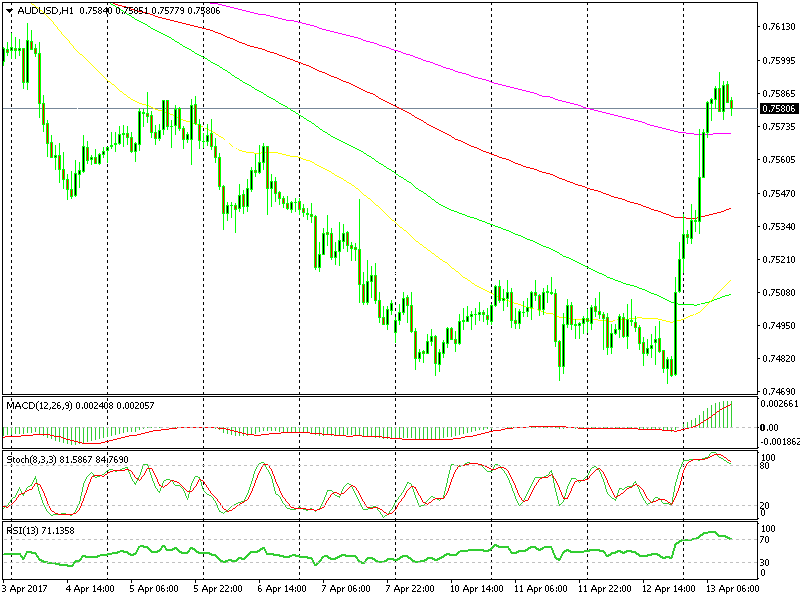

So, I´m looking to buy this forex pair today and my eyes are at the 200 SMA (purple) on the H1 forex chart at 0.7565-70. It seems pretty close to where the price is right now but this forex pair seems too strong compared to other major forex pairs right now.

Let´s wait and see if we reach the 200 SMA

Let´s wait and see if we reach the 200 SMA

The Euro, JPY and GBP have all retraced about 30-40 pips this morning, while AUD/USD has barely retraced 10 pips, so we should not expect a 60-70 pip dive here.

By the time we get there, stochastic and RSI won´t be so severely overbought so that would be the right time to open a buy forex signal in this pair. I´m watching the market closely, so hopefully I won´t miss that opportunity.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account