Selling AUD/USD And NZD/USD – Is The Pullback Over?

Last month we opened quite a few signals in AUD/USD and NZD/USD. Only one of them hit SL. However, because all the others closed in profit, we got enough pips from these two forex pairs in April.

It wasn´t a tough job to tell you the truth, although nothing comes easy in forex. The pacific Dollars traded in a downtrend for most of the last two years, so all we had to do was pick the entry price and sell.

But these downtrends don´t unfold in a straight line, there are always retraces higher. This is actually a good thing because they present us with selling opportunities.

But sometimes these retraces become too violent. On Friday evening last week, we saw some profit taking in these two pairs and that was the start of the retrace.

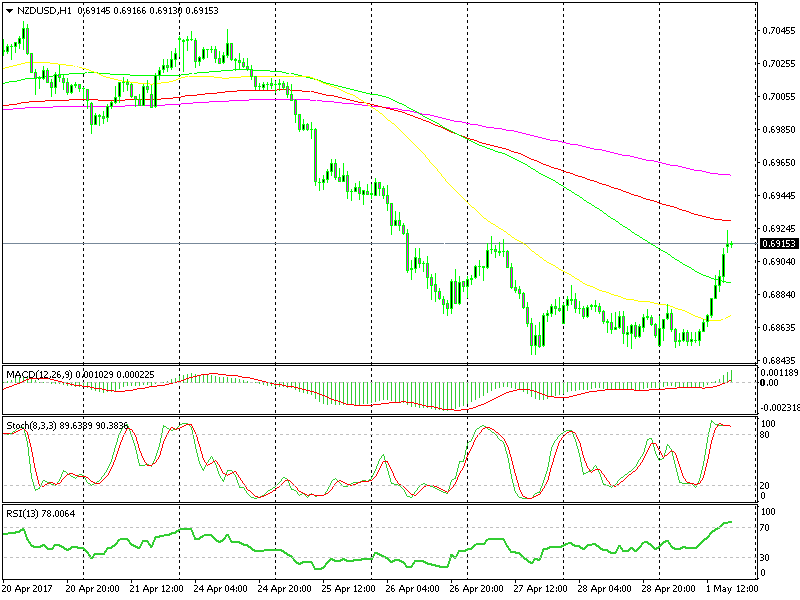

The retraces have been shallow recently so I thought that the 100 SMA on the hourly charts would provide enough resistance to end the retrace in both pairs. Nonetheless, thin liquidity and short covering have taken the price above those MAs.

A while ago we opened two sell signals in these forex pairs because of the moving averages I mentioned above and because the stochastic and RSI indicators are severely overbought. The H4 charts are becoming overbought as well, so these reasons were enough for us to pull the trigger.

We never know for sure what direction the price might take when we open a forex trade and we have no power whatsoever over the market to make things go our way. So, technical and fundamental indicators are all we have and they´re all pointing down.

The last candlestick closed as a doji which is a reversing pattern

The last candlestick closed as a doji which is a reversing pattern

The downtrend is also very strong so we´re on the right track. The NZD/USD signal is about 20 pips in red as I speak but it looks like the retrace higher has now stalled, so hopefully, the downtrend resumes again soon and we get our pips.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account