Forex Signals Brief For June 12th – 18th, Central Bank’s Policy Decisions Ahead

During the previous week, the forex market closed with a bias from the stronger dollar due to several economic events. The greenback was raised compared to a basket of peer currencies on Friday. This was due to the sterling's dramatic fall after Theresa May’s Conservative Party surprisingly failed to gain the majority in parliament in the general elections. The results jolted the market, and in response to the surprise, most of the investors switched to the US dollar.

The FED is one of the reasons why the US dollar index became the favored currency for trade. This is especially considering that the Federal Reserve is expected to hike the interest rate from 1% to 1.25% this week.

The current week is very important from a trading point of view as the key focus remains on the major Central Bank monetary policies expected this week. The policy decisions in mid-2017 will share further clues about the second half of 2017.

Lastly, the political developments in the United Kingdom will be scrutinized closely since Theresa May and the Conservative Party will be forming a government with backing from the Democratic Unionist Party.

The Week Ahead – What To Expect?

USD

- PPI m/m (Tuesday – 12:30)

- Core PPI m/m (Tuesday – 12:30)

- CPI m/m (Wednesday – 12:30)

- Core CPI m/m (Wednesday – 12:30)

- Core Retail Sales m/m (Wednesday – 12:30)

- Retail Sales m/m (Wednesday – 12:30)

- Crude Oil Inventories (Wednesday – 14:30)

- FOMC Economic Projections (Wednesday – 18:00)

- FOMC Statement (Wednesday – 18:00)

- Federal Funds Rate (Wednesday – 18:00)

- FOMC Press Conference (Wednesday- 18:30)

- Unemployment Claims (Thursday- 12:30)

- Philly Fed Manufacturing Index (Thursday- 12:30)

- Capacity Utilization Rate (Thursday- 13:15)

- Industrial Production m/m (Thursday- 13:15)

- Building Permits (Friday- 12:30)

- Housing Starts (Friday- 12:30)

- Prelim UoM Consumer Sentiment (Friday- 14:00)

- FOMC Member Kaplan Speaks (Friday- 16:45)

EUR

- German ZEW Economic Sentiment (Tuesday – 9:00)

- Eurogroup Meetings (Thursday – All Day)

- Final CPI y/y (Friday – 9:00)

- ECOFIN Meetings (Friday – All Day)

GBP

- CPI y/y (Tuesday – 8:30)

- PPI Input m/m (Tuesday – 8:30)

- RPI y/y (Tuesday – 8:30)

- Average Earnings Index 3m/y (Wednesday- 8:30)

- Claimant Count Change (Wednesday- 8:30)

- Unemployment Rate (Wednesday- 8:30)

- Retail Sales m/m (Thursday- 8:30)

- MPC Official Bank Rate Votes (Thursday- 11:00)

- Monetary Policy Summary (Thursday- 11:00)

- Official Bank Rate (Thursday- 11:00)

- Asset Purchase Facility (Thursday- 11:00)

- MPC Asset Purchase Facility Votes (Thursday- 11:00)

- BOE Gov Carney Speaks (Thursday- 20:00)

JPY

- Monetary Policy Statement (Friday – Tentative)

- BOJ Policy Rate (Friday – Tentative)

- BOJ Press Conference (Friday – 6:30)

CAD

- Gov Council Member Wilkins Speaks (Monday – 17:35)

- Manufacturing Sales m/m (Thursday – 12:30)

- Foreign Securities Purchases (Friday – 12:30)

AUD

- RBA Assist Gov Debelle Speaks (Monday – 8:30)

- NAB Business Confidence (Tuesday – 1:30)

- Employment Change (Thursday – 1:30)

- Unemployment Rate (Thursday – 1:30)

- RBA Assist Gov Debelle Speaks (Thursday – 7:40)

EUR/USD – Rangebound Currency Pair

Over the previous week, the Euro remained weaker compared to the US dollar effectively erasing most of last week’s profits. As a matter of fact, the pair seems unable to come out of its three weeks old trading range of $1.1160 – $1.1280.

The highlights of the week were:

Inflation Outlook – The news update by Bloomberg just one day before the ECB policy meeting which suggested, "ECB’s draft projections now show consumer-price growth at roughly 1.5% each year in 2017, 2018 and 2019. The previous projections in March showed rates of 1.7%, 1.6%, and 1.7%, respectively."

ECB Monetary Policy Decision- The ECB (European Central Bank) left the minimum bid rate on hold at 0.0% and the deposit rate at -0.40%. Moreover, the ECB intends to continue the bond-buying program at the same pace of EUR60bn per month until the end of December 2017.

Despite a substantially dovish stance from President Mario Draghi in the ECB press conference, the major currency pair, EUR/USD struggled to break out of the suggested trading range of $1.1160 – $1.1280.

Forex Trading Signal – Idea

This week, I will be monitoring $1.1285 to find a buy/sell position. The idea is to stay in selling below $1.1285 with a minor stop loss of $1.1310 and a take profit of $1.1160 & $1.1100

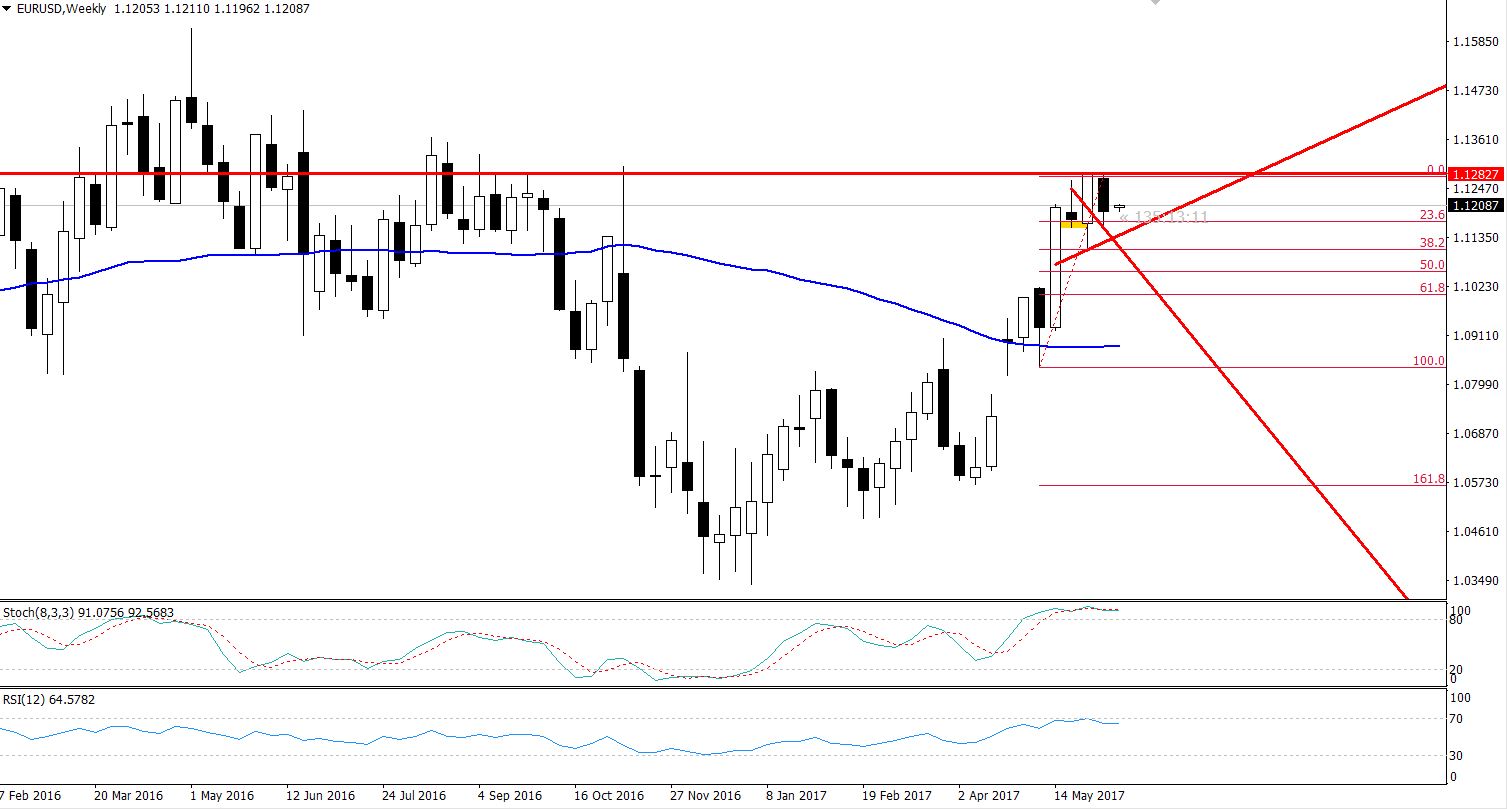

EUR/USD – Weekly Chart

EUR/USD – Weekly Chart

Technical Outlook – Weekly

The weekly outlook of the pair hasn't changed a lot. We can see the EUR/USD slumped in the second week of June and formed several pin bars right below a major resistance level of $1.1285. The candlestick patterns, such as doji and hanging man, are demonstrating investors' neutral bias.

However, the EUR/USD has dropped below the overbought territory as the momentum indicators (RSI = 64) are demonstrating the possibility of retracement. However, the overall chart seems bullish since the Stochastic and RSI are holding in the buying region.

Support Resistance

1.1148 1.1265

1.1117 1.1350

1.1074 1.1432

USD/JPY – Oversold Pair Completes Retracement

The safe haven currency pair traded on the downside against the US dollar after the release of the UK elections results. The weakness in the sterling increased demand for the US dollar which ultimately increased it's worth against all the other currency pairs.

This week, the Bank of Japan is likely to announce its latest monetary policy decision on Friday. However, the time for the BOJ Policy Rate has not been anounced yet. The Bank of Japan will release its fresh monetary policy decision with no expected change.

However, any remarks on exit strategies and upcoming policy actions by the BOJ needs to monitored closely in order to determine the trend.

Forex Trade Idea

Our previous trade idea was great as it achieved both our take profit levels the very next day. For now, $110.700 is a good trading level to watch. The idea is to stay in selling below $110.700 with a minor stop loss of 111.250 and a take profit of $109.750. This is while keeping in mind that this all depends upon the Fed policy meeting this week.

USD/JPY – 4 Hours Chart

USD/JPY – 4 Hours Chart

Technical Outlook – Weekly

In the 4-hour time frame, the USD/JPY has soared to 61.8% Fibonacci retracement of $110.700. Aside from Fibo level, this is the same level, which has previously worked as a double bottom support. As we know, once broken a support becomes resistance, hence the same rule applies here.

The breakage above the $110.750 level is likely to add further room for buying until $111.700. At the moment, the pair is trading below a 50-periods moving average, which is extending a strong resistance at $111.10. The prices below moving average demonstrate the selling bias of traders. We need to look for the sell opportunities ahead.

Support Resistance

109.93 111.31

109.43 112.19

108.55 112.69

Conclusion

The market is likely to trade the rate hike sentiment, increasing their bets on the US dollar in order to benefit from the rate hikes as early as possible. Besides this, the policy actions from the BOJ, BOE, and SNB are worth monitoring. We will make sure to release updates regarding the latest news and analysis on decisions and trade ideas ahead after the policy decisions are out. Keep following us for the fresh Forex Trading Signals to stay ahead!