Gold Sellers Extend Exposure – US Economic Events In Focus

Thankfully we have had a good start to this week – in the Asian session two of our forex trading signals closed in profit, one in gold and the other in GBP/USD. We hope to keep up this momentum and are looking forward to sharing trading signals in the US indices as well.

Since it's Monday, we are facing thin trading volume and price movement in the market. The volume is likely to remain low tomorrow as well due to the public holiday in the United States.

Gold is trading under pressure amid signs that several central bankers around the globe are preparing to tighten the monetary policy. As a result, gold will become a less attractive investment.

This week, we need to trade cautiously as the market is likely to determine the long-term trends after the release of US FOMC meeting minutes and labor market figures by the end of this week.

Forex Trading Signals – Intraday

We have closed our initial trading signal at $1237 manually, although the target was $1236. The idea is to stay on the sell side only below $1240 with a stop loss above $1244.

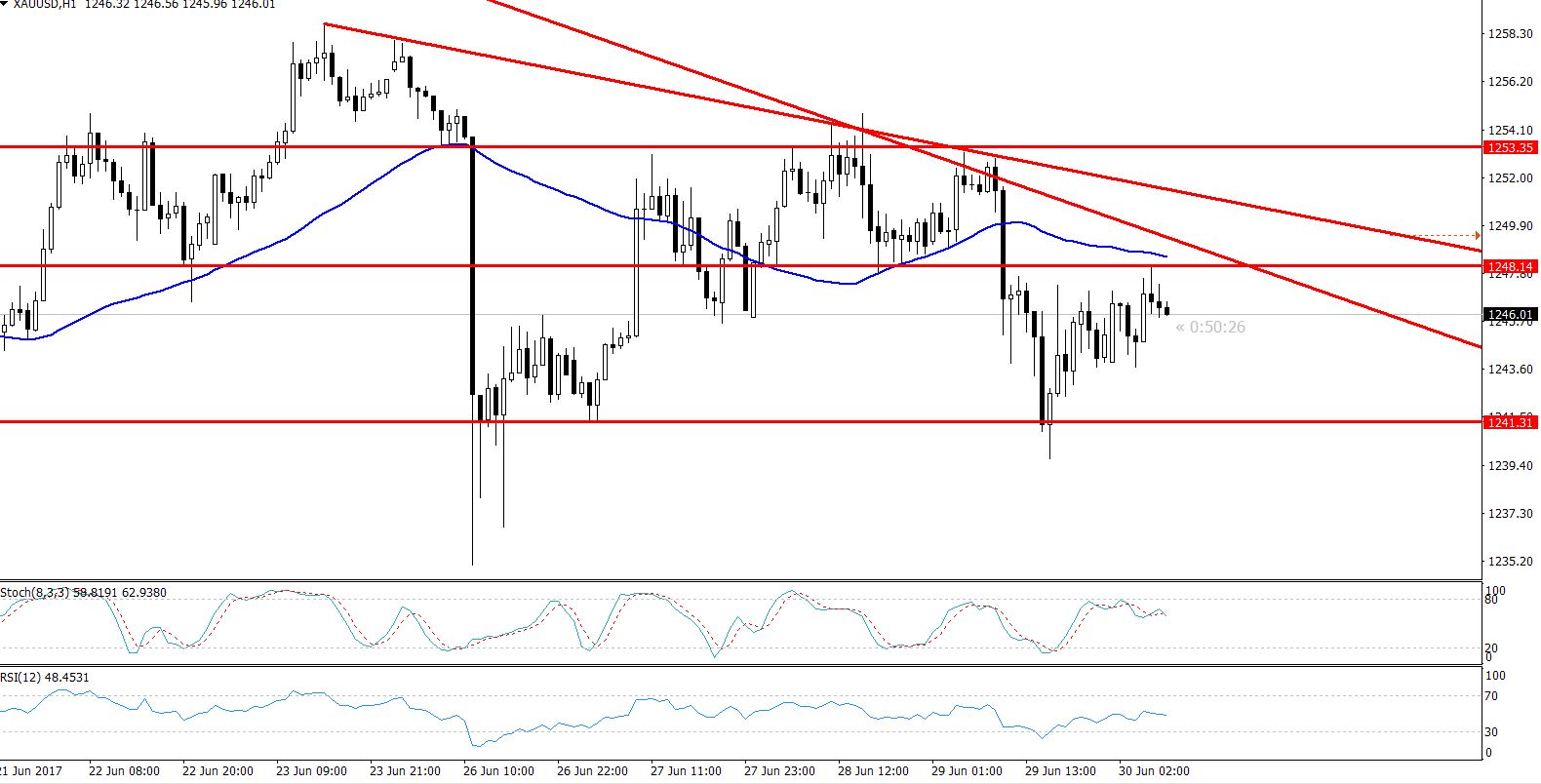

Gold – Triple Bottom Breakout – Hourly Chart

Gold – Triple Bottom Breakout – Hourly Chart

Technical Outlook – Intraday

On the hourly chart, we can see a breakout of the triple bottom pattern which is demonstrating investors' selling behavior. It's extending a solid support at $1236 and the breakage is likely to push it lower towards $1232.

Whereas, the RSI & Stochastic are suggesting traders' bearish bias. On the hourly chart, 50-periods EMA is extending a strong resistance at $1244. The upside crossover is likely to add further room for buying until $1249. to learn more about moving averages read our trading strategy article here.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account