Forex Signals Brief July 17th – 23rd, Global Central Banks In The Spotlight

Welcome back, traders. Get ready for new opportunities this week. It's all about the global central banks but we need to switch our focus from the US dollar to the other major currencies such as the Australian, Euro, Japanese Yen and the British Pound.

Over the previous week, the US had a bad run due to the weaker than anticipated inflation figures. As we discussed in the Forex Signals Brief on Thursday, Fed Chair Yellen along with other officials sounded dovish because of their weaker outlook on inflation. In response, investors jumped into gold & stock market indices.

Top Events On This Week's Docket

AUD – Monetary Policy Meeting Minutes will be in focus on Tuesday at 1:30 (GMT) in order to trade the Aussie. Why is this important? It's a comprehensive report of the RBA Reserve Bank Board's most recent meeting. It presents in-depth insights into the economic conditions that shaped their decision as to where to set interest rate. It may have a significant impact.

GBP – BOE Gov Carney is due to speak at the unveiling of the new £10 note featuring Jane Austen, in Hampshire at 13:30 (GMT) on Tuesday. The event is likely to be mute but is still worth watching. More importantly, the UK CPI inflation figures will be released at 8:30 (GMT).

Inflation has always played a significant role in moving the Sterling. It certainly yields quite a good number of pips. Inflation figures will have a notable short-term influence on the markets. I will also help us predict the potential outcome of the Bank of England's August policy meeting.

JPY – BOJ Monetary Policy is scheduled to come out on Thursday, but the time of release is still unknown. BOJ is expected to keep the interest rate unchanged at -0.10%, but we need to monitor the bank’s assessment of economic growth and inflation outlooks. Let's see if BOJ joins the race of rate hikes with the ECB and BOE.

ECB – Minimum Bid Rate & ECB Press Conference are due to be released at 11:45 & 12:30 (GMT). I don't think the ECB will hike the rates as it seems too early to do so.

The odds of any change in minimum bid rates at this meeting are very low, yet the main focus will remain on the press conference. I was looking at the growth fundamentals of Eurozone, the situation isn't as bad as it was before. Therefore, the ECB can also take back the idea of tapering the bond buying program.

Overview Of The Forex Majors

EUR/USD – Triple Top Pattern Still In Play

In its third week now, the single currency Euro is holding below the triple top resistance level of $1.1470. The EUR/USD has tested this multi-year old resistance but has remained unsuccessful in breaking out.

Now, the market has another chance to determine the long-term trend for the EUR/USD. Zooming out on the weekly chart of the major currency pair, we clearly can see the behavior of the market. Every time, EUR/USD comes near $1.14750, it's thrown back to place new lows.

So the question is, can we see something exciting and tradable in the EUR/USD this week? Well honestly, I'm looking forward to the release of ECB rate decision and press conference. Something big is coming so get set to ride.

EUR/USD – Weekly Chart – Multi-Year Resistance

EUR/USD – Key Trading Levels

Support Resistance

1.1241 1.1475

1.1176 1.1515

1.1072 1.1620

EUR/USD Trading Idea

This week, the trade idea is to have a sell position below $1.1475 with a stop loss above $1.1495 and take profit $1.1375 and $1.1330. On the other hand, the buy positions seem suitable above $1.1490 this week.

USD/JPY – Worth Watching Currency Pair

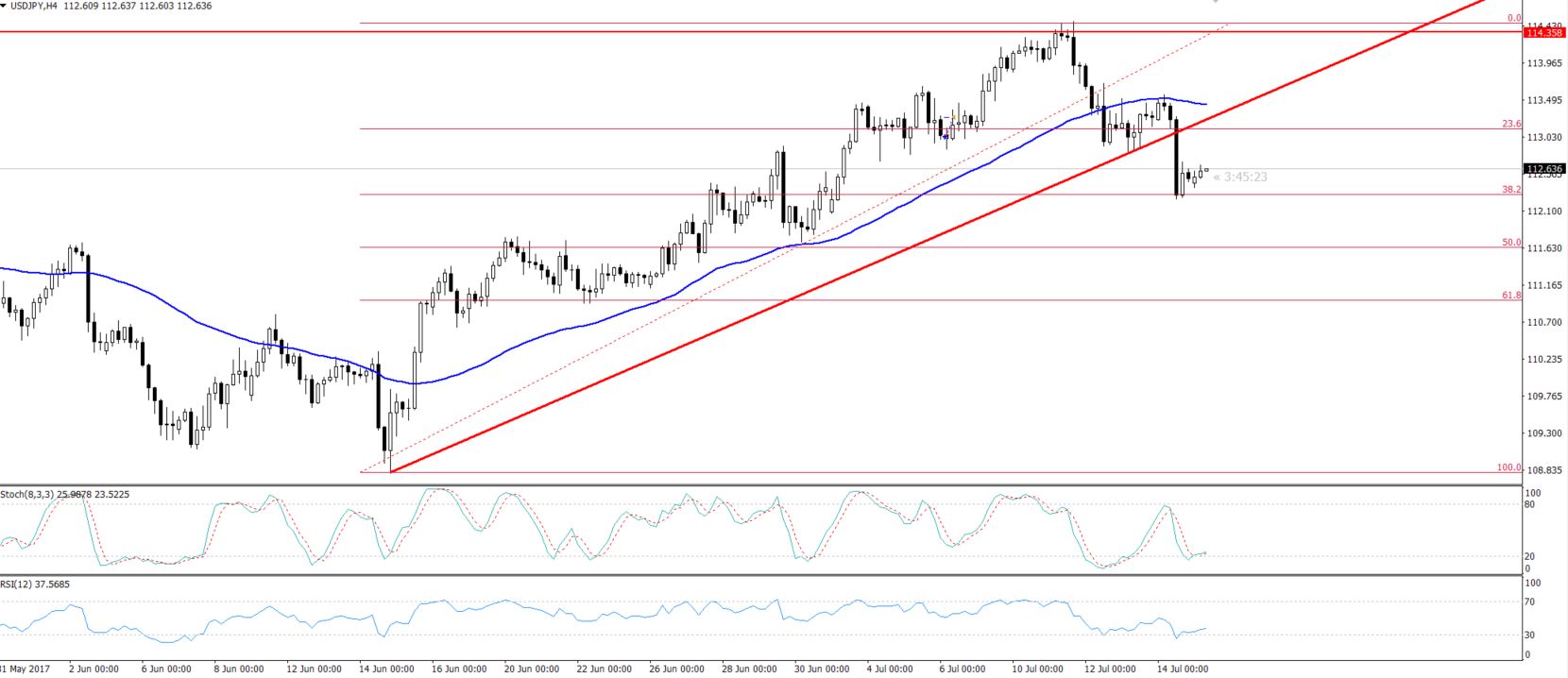

It was a good bearish run for the USD/JPY for both technical and fundamental reasons. In my previous report, I talked about the double top level of $114.350. The level urged investors to stay on the downside along with the surprisingly bad US inflation figures. Now, it's again trading on the top of the earlier range of $111.750- $112.650. $112.650 is still a significant support.

Technically, looking at the pair's 4-hour chart shows that it has broken out of an ascending triangle pattern. It is now providing a solid resistance at $112.900. The pair has entered the oversold region. RSI and Stochastic are holding below 50 but have already begun to come out of the oversold region.

If so, the pair could soar to test the 50-periods EMA at $113.250 before dipping again. Traders, to get a better understanding of how to profit from a moving average trading strategy see the article here.

USD/JPY – Key Trading Levels

Support Resistance

111.98 113.30

111.46 114.10

110.66 114.62

USD/JPY Trading Idea

This week, investors are advised to closely watch $113.08 and stay in sell below and buy above this level. The target for sellers is $112.200 & $111.600. On the other hand, buyers can aim for $113.600 & $114 this week.

Lastly, the FX traders are advised to stay calm and take short term positions before the occurrence of this week's economic events such as monetary policy announcements and UK inflation figures. Refer to FX Leader's detailed articles on the how to trade EUR/USD signals and how to profit from the USD/JPY signals. Good luck and get ready for exciting forex trading signals!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account