Gold Bullish On Sentiments – Dovish Fed In Focus

On Friday, our forex trading signal on gold made some nice profits, pocketing nearly +40 pip and closing our position at $1250. Today, the gold tossing in a range of $1253 – $1256. Asian investors seem wary of entering the market due to the release of the US GDP and Fed Fund Rate which are likely to shake the gold prices.

Fed Monetary Policy – The Sentiment Analysis

Fx Junkies are expecting a dovish monetary policy this month since the Fed Fund Rate is expected to remain unchanged at 1.25%. Moreover, the FOMC Statement is also expected to go mute unless it surprises the market with something new, which is highly unlikely.

Therefore, I'm expecting investors to continue trading with weaker dollar sentiment, ultimately supporting the demand for haven asset gold. So, this week gold is likely to trade with bullish sentiment before the release of the Fed fund rate.

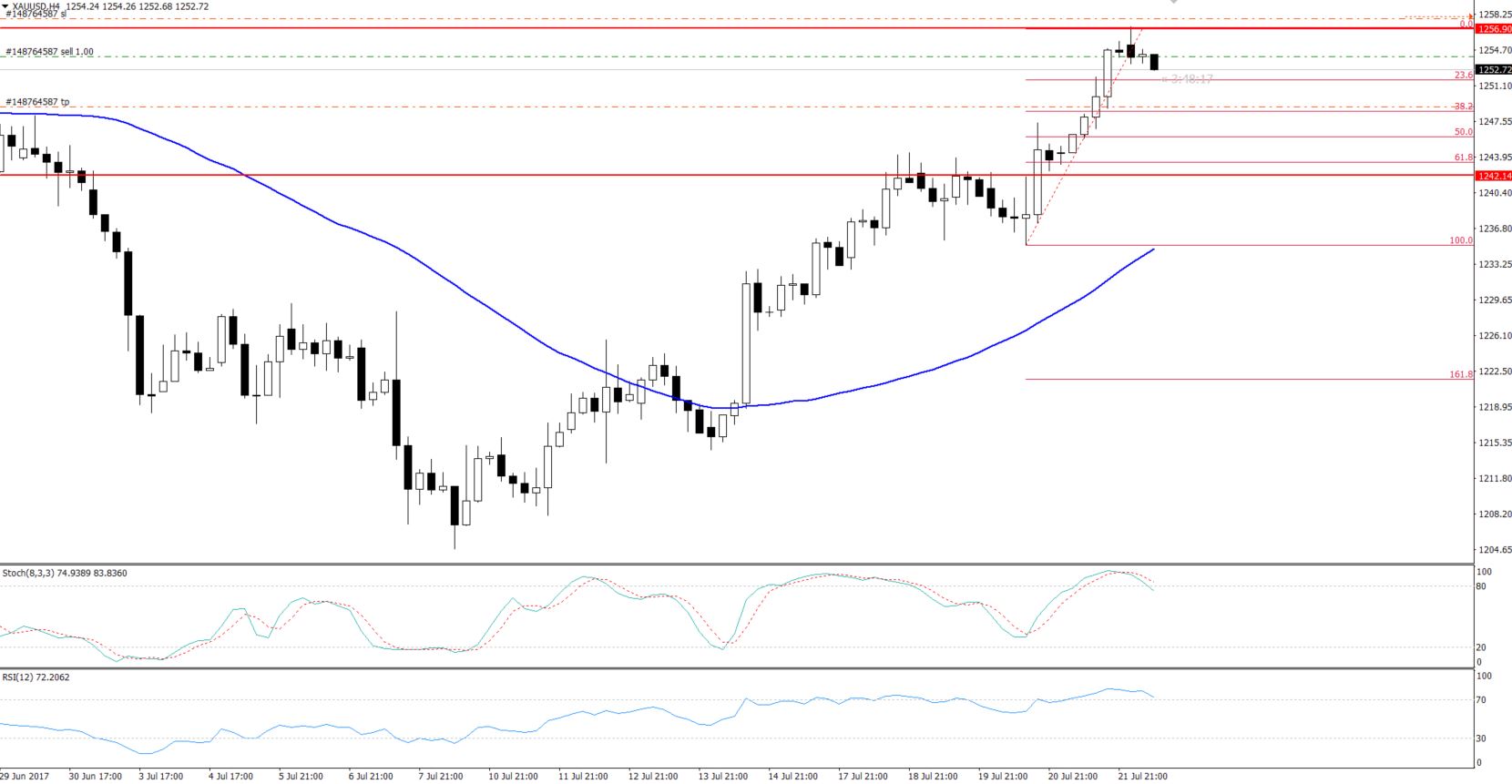

Nevertheless, I'm not saying to buy right now. We need to wait for a slight selling in order to buy at low prices. Looking at the gold chart (H4), both of the momentum indicators, the RSI and Stochastic are holding above 80 & 70. This signifies that the gold is overbought and that it may drop to complete 23.6% Fibonacci retracement at $1251 and 38.2% retracement at $1248.50. Hopefully, it will complete this by the end of today or tomorrow. For an in-depth explanation on Fibonacci retracements how to compute these levels, make sure to check out Fx Leaders Fibonacci forex trading strategy article.

Gold – 4-Hour Chart – Fibonacci Retracement

Gold – 4-Hour Chart – Fibonacci Retracement

Gold Trading Plan

Today during the early Asian session, I opened a sell signal at $1254.50 with a stop loss above $1257 and take profit at $1249. At the moment, the signal is showing 15 green pips. Investors are advised to move their stops at the break even point to avoid reversals. Refer to FX Leaders article on how to trade & profit gold signals for more tips of the trade!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account