Forex Signals Brief July 26th – How To Trade FED Rate & FOMC

Today we can finally expect the volatility trigger we have been waiting for. Today is the day of the US FOMC Statement & Fed Fund Rate. Read ahead to find out how we can expect these releases to impact the market and how to trade accordingly!

Fed Monetary Policy Decision

The US Federal Reserve Monetary Policy decision is due to be released at 18:00 (GMT) and it is expected to influence the global markets. It includes the Fed Fund Rate which is not likely to change this month, though the odds are higher for the next month. Therefore, it looks like the US dollar will stay under pressure before the release of more fundamental. The FOMC Statement is also definitely worth watching. Let's take a quick look at how to trade the FOMC Statement.

How To Trade FOMC Today?

Before we begin, let us remember that the Fed has hiked its interest rate by 25 basis points for the second time this year. The most recent one was in June. To assess the progress, I was analyzing the US economic indicators, their inflation, GDP, and labor market figures.

Inflation: The US CPI holds at 1.7% in June, which is weaker than its 2.3% yearly figure back in the month of January. That's the first reason the Fed needs to keep rates unchanged.

Fed Balance Sheet: I'm not sure about the Balance Sheet/the Bond Buying Program. Previously, the Fed has been using the unconventional tool of increasing the money supply and has purchased an abundance of asset backed securities. But, in the Fed's previous policy report they showed their intention to lower the Balance Sheet by tapering asset purchases. That's something we can expect them to discuss today.

Impact of Fed Policy Decision

Interest Rate: Unchanged (Most Likely Outcome)

US Dollar – Weaker // Bearish

Gold – Stronger //Bullish

Stocks – Stronger //Bullish

Interest Rate: Hike

US Dollar – Stronger //Bullish (Massive Buying Expected)

Gold – Weaker // Bearish (Heavy sell-off expected)

Stocks – Weaker // Bearish

Lastly, the Prelim GDP q/q from the United Kingdom is scheduled to release at 8:30 (GMT) with a forecast of 0.3%, higher than the previous 0.2% figure. It places more pressure on the BOE to hike the rate sooner.

EUR/USD – Sideways Trend – Get Ready For Breakout

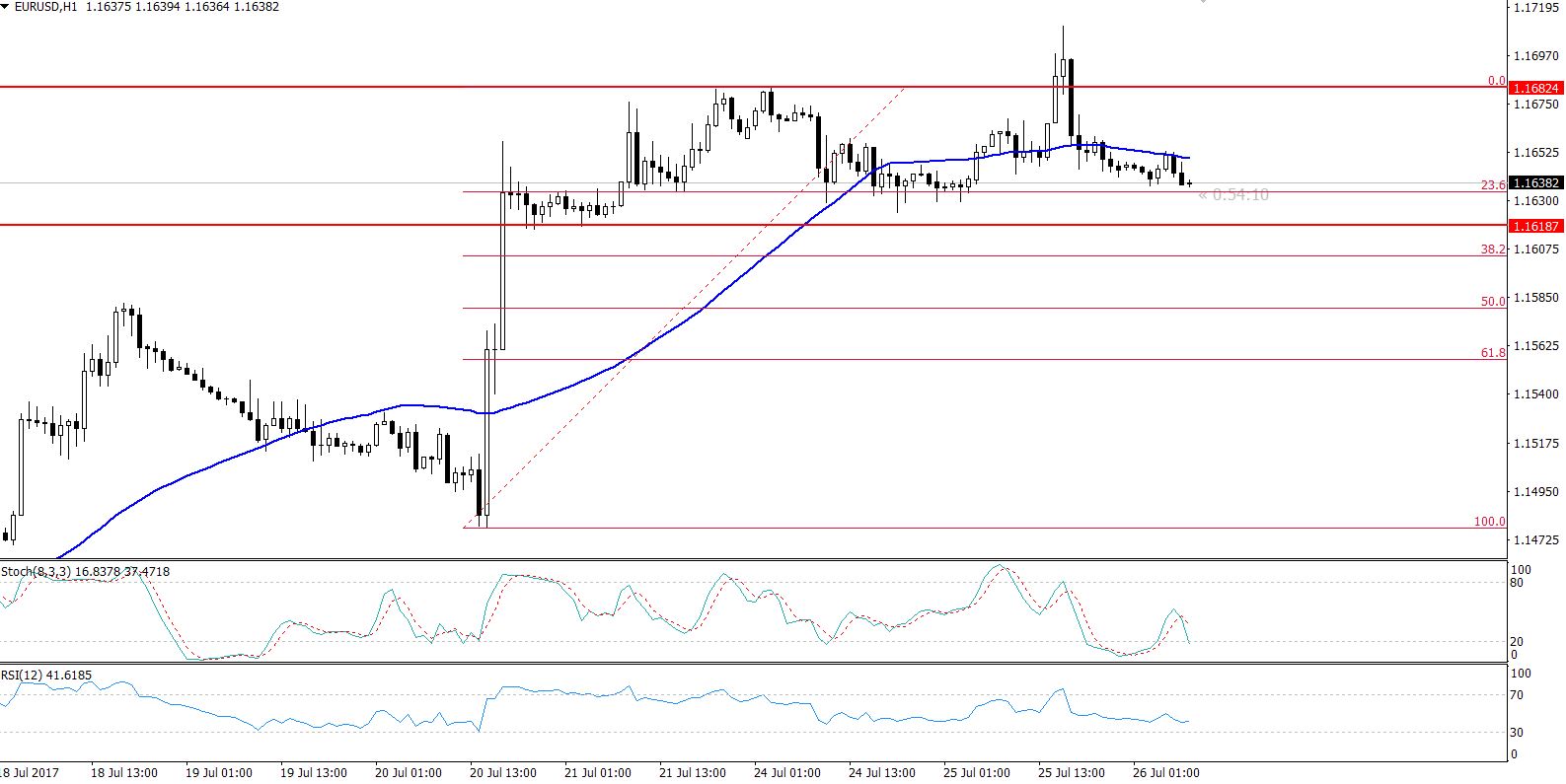

The EUR/USD hasn't moved much this week since investors were waiting for the high impact economic events today. The pair is still holding below $1.1710, after breaking above $1.1475. On the hourly chart, we can see the pair has maintained a narrow trading range of $1.1618 to $1.1675.

The July US Conference Board's confidence index rose to 121.1 from the 117.3 in the last month. Despite the better than expected economic figures from the United States, the pair has failed to show any direction.

Technically, the EUR/USD has come out of the overbought region and has already completed 23.6% Fibonacci retracement at $1.1635. Still, breakage below this level is likely to give us another selling opportunity with a target of $1.1600, the 38.2% Fibonacci level.

EUR/USD – Hourly Chart – Trading Range

EUR/USD – Hourly Chart – Trading Range

On the 4-hour chart, the RSI, and Stochastics are trading at 54 & 17 respectively, signifying that investors are ready to take bullish positions if necessary. It all depends on today's economic indicators. For tips on how to upgrade your trading techniques, take a look at our Fx Leaders support and resistance trading strategy article.

EUR/USD – Key Trading Levels

Support Resistance

1.1645 1.1752

1.1593 1.1842

1.1344 1.2001

EUR/USD Trading Plan

The idea is to stay in buying above $1.1625 with a minor stop below $1.1610 and take profit of $1.1695. To learn more about trading EUR/USD, read our FX Leaders article on how to trade the EUR/USD signals.