Good morning traders.

It seems to be a common theme at the moment – markets grind their way higher during Asian trade – only for the US and Europe to come online and promptly sell-off.

That appears to be the case once again for the AUD/USD and NZD/USD.

Some more positive jobs data out of the US overnight helped boost the USD in the short term, however equity markets sold off as there appeared to be more tension on the horizon between President Trump and North Korea.

There’s some potentially market moving data out this morning with Australian Consumer Sentiment and Chinese CPI – so watch closely for signs of continued downward momentum.

Morning Snapshot

AUD – The Aussie is grinding its way lower along the trend line that we wrote about yesterday. Any signs of negative Consumer Sentiment will be sure to help with the selling.

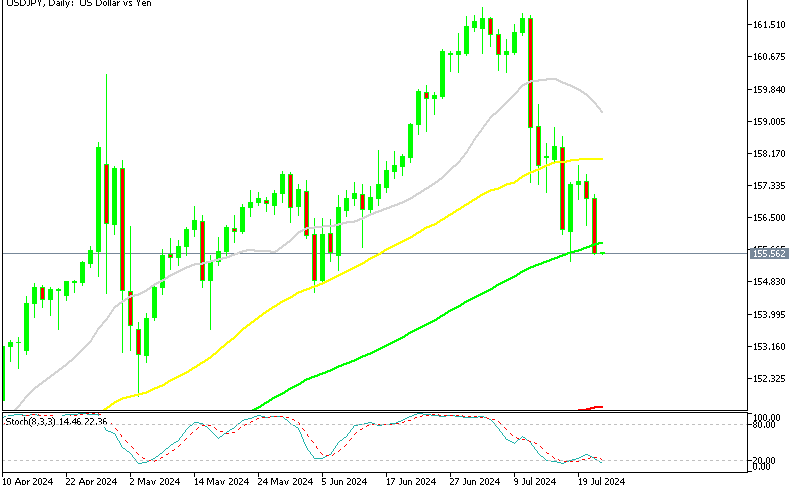

Yen – Positive jobs spiked the USD/JPY higher before it sold off for the rest of the US session. We are now firmly targeting support at 110.000 and should test that level in today's Asian session.

NZD – The Kiwi was one of the weakest performers in recent days as traders wait on the RBNZ. Given its strong downside momentum, this is one to consider trading more negative newsflow.

Nikkei 225 – Japanese equities will likely open lower in line with the US, after significant selling came into the market in overnight trade.

Economic Data to Watch This Week

NZD

-

RBNZ Interest Rate Decision (Thursday)

-

Electronic Retail Sales (Thursday)

-

Business PMI (Friday)

AUD

-

Westpac consumer sentiment (Wednesday)

-

Chinese CPI (Wednesday)

-

Chinese New Loans (Thursday)

Yen

-

Tertiary Industry Activity (Thursday)

-

Holiday (Friday)