Forex Signals US Session Brief, August 14th – Trading Opportunities in a Quiet Market

Today is supposed to be pretty quiet since it is a summer Monday and the data is scarce, but there are trading opportunities to be had. We seized two of these opportunities, but there are more trade setups in sight, which we detail below.

You can still make pips, even on a quiet summer Monday such as this

The Chinese Disappointment

We don’t trade the Chinese Yuan and honestly, it would be the most boring currency to trade, since it is pegged to the US Dollar more or less, with a very tight range to fluctuate. Nevertheless, the Australian economy is closely linked to the Chinese economy since China is its biggest export partner by far. So, the Australian Dollar affects the AUD and to some extent the NZD as well and that´s why we keep an eye on the Chinese economic numbers.

We had a round of economic figures from China this morning and they weren't very good. The pace of expansion for industrial production, fixed asset investment and retail sales slowed, though it is still expanding.

On the forex calendar, the Chinese section looks red, though compared to other large economies, the Chinese economy is still progressing at a very decent speed.

AUD/USD lost some considerable ground this morning. You´d assume that this is due to the soft Chinese numbers, but this is more of a retrace following the jump on Friday after the disappointing US inflation numbers.

This is one of the reasons we bought NZD/USD; because the economic data didn’t have much of an impact on the Kiwi this morning, chances are that it will turn back up higher sooner rather than later.

Trades in Sight

Speaking of NZD/USD and AUD/USD, we opened two forex signals this morning. Although we couldn’t open a buy signal in these two forex pairs, since they are positively correlated. Instead, we took another path and decided to trade USD/CAD.

Below we´ve listed the reasons to trade NZD/USD, USD/CAD and USD/JPY:

NZD/USD

- Positive economic data from New Zealand today

- More resilient than its neighbour, the Aussie

- Oversold on the H1 chart (stochastic oversold)

- The 50 SMA is providing solid support

- The last few candlestick show that the move lower might be over

USD/CAD

- H1 chart is overbought

- The 50 SMA on the H1 chart is providing resistance

- The 20 SMA on the H4 chart is providing resistance

- The upside looks weak above 1.27, judging by the price action in the last few hours

- The H1 chart is severely overbought (stochastic and RSI are well overbought)

- The last several hourly candlesticks look pretty bearish

- The 100 SMA is providing resistance on the same time frame chart

- The h4 chart is overbought as well

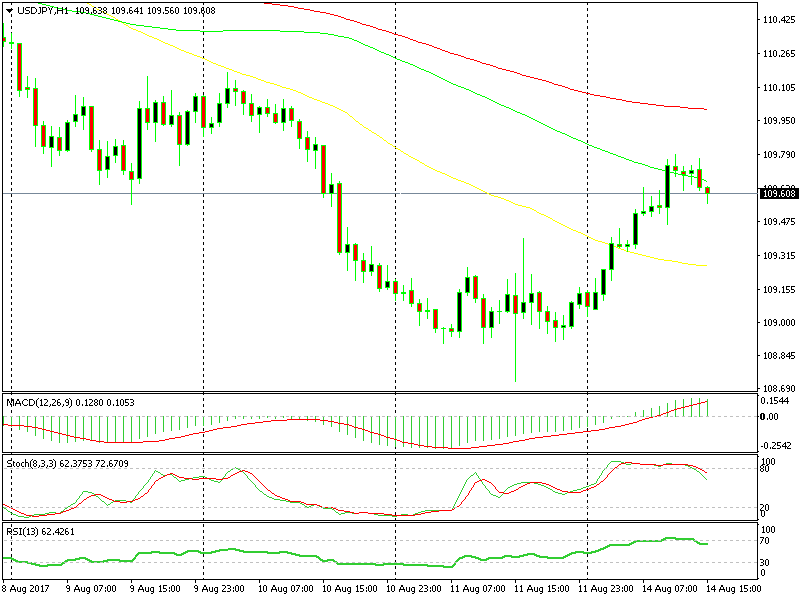

The USD/JPY chart setup is pointing down

The USD/JPY chart setup is pointing down

Trade Idea: We haven’t opened a signal in USD/JPY yet, but we´re thinking about it. In case we don’t, you now have all the tools to make the decision by yourself. We suggest that you sell this pair at the 100 SMA (H1 chart) with a stop above 100, leaving the take profit target open.

USD Retracing or is this a Proper Reversal?

Last Friday the USD made another move lower when the US CPI (consumer price index) missed expectations for both the monthly and the yearly numbers. This comes after months of heavy USD losses. However, last week the Buck put up a fight and it reversed some of the losses.

Right now, traders don’t know whether to buy or sell the USD. The confusion stems from the strong USD downtrend this year and the last decline we saw last week after the weak CPI numbers point in one direction.

On the other hand, the Buck has lost too much during this time and the market is aware of it, so I see the reluctance to push lower/higher in many forex majors.

EUR/USD is finding great difficulty between 1.18 and 1.19. GBP/USD has formed a top around 1.3250-60, while NZD and the AUD can’t push any higher.

All forex majors have reached some important levels and don’t seem to have the stamina to push further, apart from the Yen. USD/JPY broke the big support level at 1.10 last week so we´re not challenging this forex pair right now.

But as we said, other major currencies don’t seem to be able to push higher against the Buck and after a month of one way traffic, the market is probably getting ready for a decent pullback or even a reversal.

We have quite a few important economic releases from the US this week, (such as retail sales tomorrow and building permits on Wednesday), so the market is probably waiting for these numbers. Bear with us on what promises to be another slow summer Monday.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account