Forex Signals Brief for August 31st – The Day Before the Big Day!

The EUR/USD and USD/CAD traded in line with the forecast in the Forex Signals Brief for August 30th. As planned, the Loonie is up nearly 1

The EUR/USD and USD/CAD traded in line with the forecast in the Forex Signals Brief for August 30th. As planned, the Loonie is up nearly 170 pips, while the Euro is down +80 pips against the Buck. That's exactly the positive start that we need before the big day tomorrow.

Top Economic Events Today

US Dollar – USD

Unemployment Claims are due to release at 12:30 (GMT) with a slight negative forecast of 237K compared to 234K last month. The figure shows the number of individuals who filed for unemployment insurance for the first time during the past week. It's weekly data so it only impacts the market for a couple of hours.

Later, at 13:45 (GMT), the Chicago PMI is expected to release with a slight change of 58.7, compared to 58.9 in the past. Chicago PMI is a leading indicator of economic health. Businesses react quickly to market conditions, and their purchasing managers hold the most up to date insight into the company's view of the economy. The Pending Home Sales m/m will also be worth trading at 14:00 (GMT).

Canadian Dollar – CAD

GDP m/m is due at 12:30 (GMT) with a forecast of 0.1%, comparatively lower than the previous economic growth of 0.6%. Economies mostly release the GDP figures on a quarterly basis but Canada is unique in that they release fresh GDP data on a monthly basis. A Canadian quarterly GDP figure is also released, however, it's merely a summation of the monthly data.

Top Trade Setups Today

EUR/USD – Completed 50% Retracement

The single currency traded exactly as suggested in my earlier report, helping us secure 85 pips. For now, the pair is holding exactly above the 50% Fibonacci retracement level of $1.1865.

EURUSD – 4-Hour Chart – Fibonacci Retracement

EURUSD – 4-Hour Chart – Fibonacci Retracement

Looking at the 4-hour chart, the momentum indicator is suggesting that sellers are exhausted and they may take profit here at $1.1865. But the downward breakage will lead the pair towards 61.8% retracement level of $1.1820. This will be my buy entry area.

EURUSD – Key Trading Levels

Support Resistance

1.1847 1.1950

1.1812 1.2018

1.1744 1.2053

EUR/USD Trade Plan

Today, I'm waiting for confirmation to buy above $1.1865. If the market signals a breakage, then buying at $1.1820 will be a good idea.

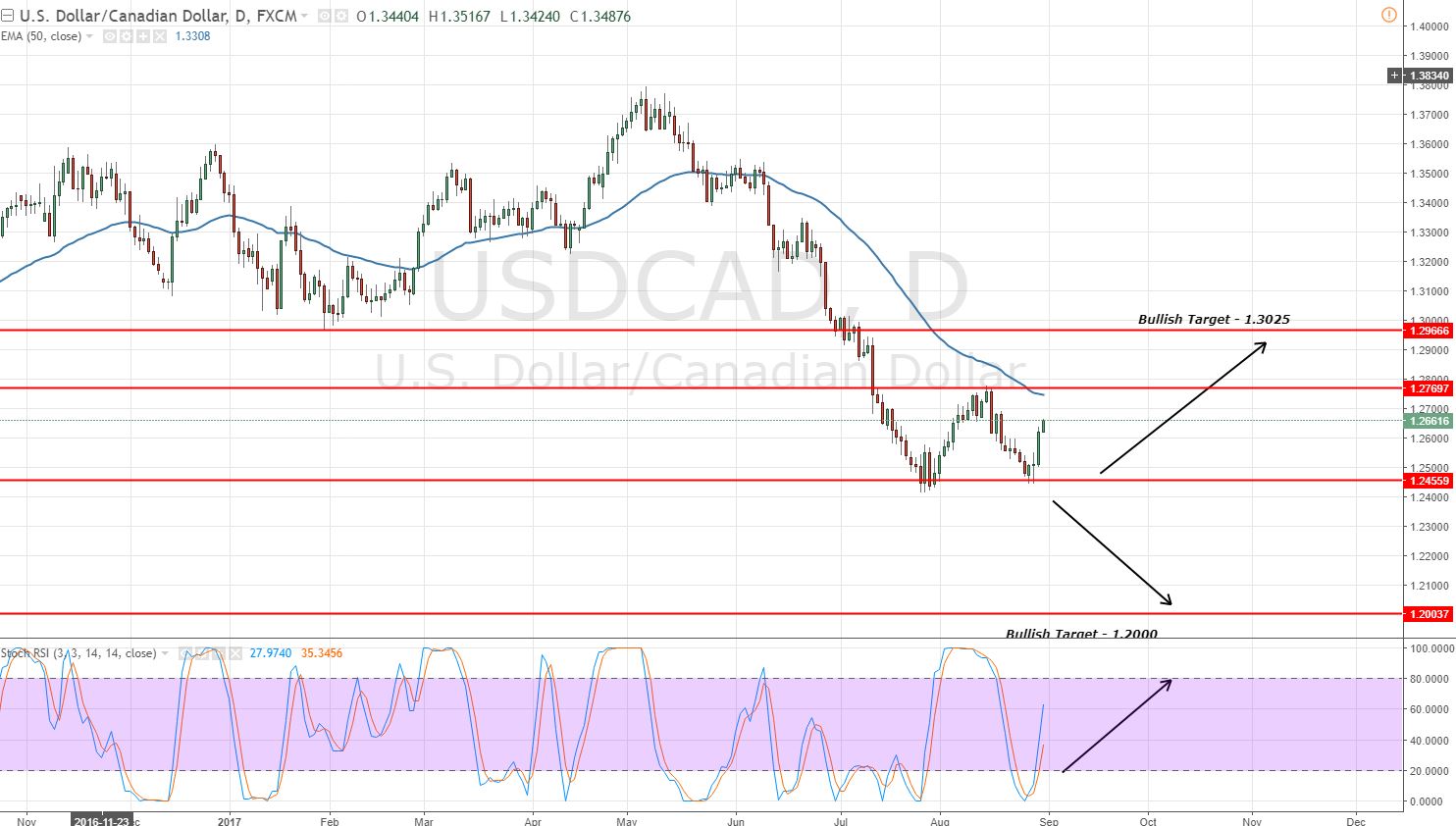

USD/CAD – 175 Pips – More to Come

The Loonie is a darling – the swing trade idea is working really well for us. Today, the USD/CAD is depending on the Gross Domestic Product to determine it's further moves.

USDCAD – Daily Chart – Bullish Reversal

USDCAD – Daily Chart – Bullish Reversal

Technically, the pair is forming strong bullish candles to reach our target of $1.2770 & $1.3025. The leading indicators Stochastic and RSI have entered a buying zone, crossing above 50 in the daily timeframe.

USDCAD- Key Trading Levels

Support Resistance

1.2585 1.2637

1.2533 1.2658

1.2501 1.2711

USD/CAD Trade Plan

I'm continuing with the same plan: stay bullish above $1.2425 with a closing partial position at $1.2765. Overall the target is $1.2800. Good luck, the real game is beginning tomorrow, so save your margins.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

EURUSD – 4-Hour Chart – Fibonacci Retracement

EURUSD – 4-Hour Chart – Fibonacci Retracement  USDCAD – Daily Chart – Bullish Reversal

USDCAD – Daily Chart – Bullish Reversal