WTI Crude Oil Brief: October 12, 2017

November WTI crude oil futures are currently under pressure, down almost a dollar for the session. This week’s crude trade has proven cha

November WTI crude oil futures are currently under pressure, down almost a dollar for the session. This week’s crude trade has proven challenging due to the unconventional Columbus day inventory cycle. In addition, we are also beginning to see considerable volume dilution between the November and December WTI futures contracts. As of now, November is trading at nearly a three-to-one ratio over December.

Here are this week’s inventories:

Event Previous Projected Actual

API Crude Oil Stocks -4.079M NA 3.097M

EIA Crude Oil Inventories -6.023M -1.991M -2.747

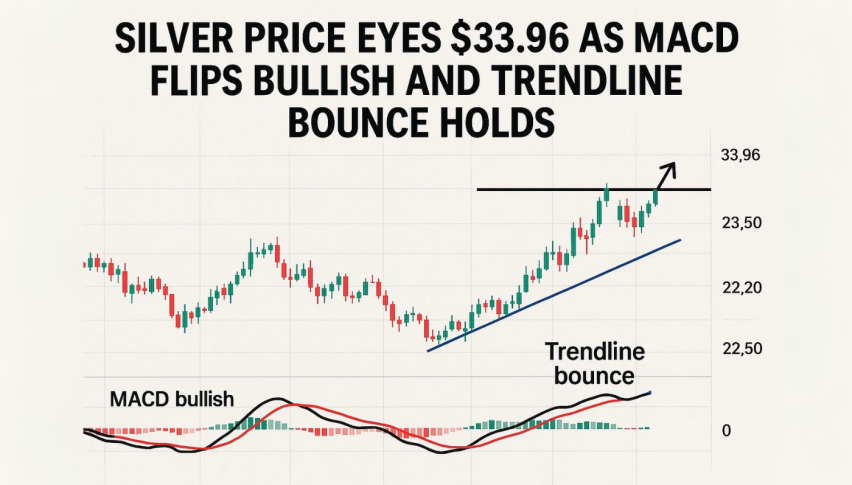

Technicals

The roadmap for WTI crude is becoming compressed, as the bulk of trade is taking place in between the Daily SMA and Bollinger Midpoint.

November WTI Crude Oil Futures, Daily Chart

November WTI Crude Oil Futures, Daily Chart

Compression can be a good thing. As a market tightens, we can expect an eventual directional move. That is exactly what is happening in this market. Let’s take a look at some of the keys:

-

Resistance at the Daily SMA $50.95.

-

Support zone between the 20 Day EMA and Bollinger MP, $50.36-$50.25.

-

$50.00 remains a magnet for price action.

-

Downside support at 62% retracement of Sept., $49.48.

-

Downside support at 78% retracement of Sept., $48.59.

Overview: As rollover becomes more of an issue in the futures market, WTI will show the propensity for a directional move. The key number of $50.00 is still the most important number on the board and a likely catalyst for participation in upcoming sessions.

For the rest of today’s session, I will be looking for a definitive break below $50.00, and go long from the lower support number of $49.48 with an initial stop below $49.25. This level should produce positive price action, so looking for a profit of 10-25 ticks is not unreasonable.

Also, 1:1 R/R scalps from the Daily SMA of $50.95 with a stop above the intraday high of $51.13 are also viable.

As always, trade smart and for tomorrow!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

++10_12_2017.jpg) November WTI Crude Oil Futures, Daily Chart

November WTI Crude Oil Futures, Daily Chart