Top Events & Setups To Trade Today – EUR/USD & GBP/USD in Focus!

Good Morning, traders. It's such a phenomenal beginning of the week. Our forex trading signals closed more than 100 pips. The long-term pos

Good Morning, traders. It's such a phenomenal beginning of the week. Our forex trading signals closed more than 100 pips. The long-term position in Gold is doing great, and the short-term position helped to pocket nearly 55 pips. Likewise, another signal shared in A Quick Trade Setup on EURJPY closed 60 pips. Now I'm serving up EUR/USD and GBP/USD to secure high probability trades.

Top Economic Events Today

The investor's focus is on the high impact fundamentals coming out from the UK and the US. Let's take a look.

Great Britain Pound – GBP

Inflation Report Hearings – At 10:00 (GMT), the Bank of England's (BOE) Monetary Policy Committee will be releasing the inflation report. The increase in inflation is likely to force BOE to increase the interest rates. The sudden movement will not be catchable, but it will help us with a position in the long-term trends.

US Dollar – USD

Existing Home Sales – Today at 15:00 (GMT), the National Association of Realtors will be releasing the existing home sales. It's expected to be 5.42M which is slightly higher than previously. Since it's a monthly figure, we may see slight changes in the dollar with the release of data.

Fed Chair Yellen Speaks – Later at 23:00 (GMT), Fed chair Yellen is due to participate in the panel discussion, "In Conversation with Mervyn King," at the New York University Stern School of Business. It's not likely to have any impact on the market.

Top Trade Setups Today

EUR/USD – Formation of Double Bottom

Before we begin, let's recall the previous update entitled Nov 20: Top Economic Events & Trade Setups In Forex Today. The trade plan on EUR/USD traded exactly as suggested.

Now, the EUR/USD has formed a double bottom pattern near $1.1725. On the 4-hour chart, the pair has formed a candlestick pattern "hammer" which is weakening the bearish trend on the Euro.

EURUSD – 2-Hour Chart – Double Bottom

EURUSD – 2-Hour Chart – Double Bottom

I'm still looking at the same levels as discussed earlier. The EURUSD is likely to find support at 38.2% Fibonacci retracement level of $1.1725 and $1.1675 61.8% retracement level.

EUR/USD – Key Trading Levels

Support Resistance

1.1699 1.1786

1.1666 1.184

1.1612 1.1873

Key Trading Level: 1.1753

EUR/USD Trading Plan

The idea is to stay bullish above $1.1725 and $1.1675 with a stop loss below $1.1640 and take profit of $1.1770 and $1.1820.

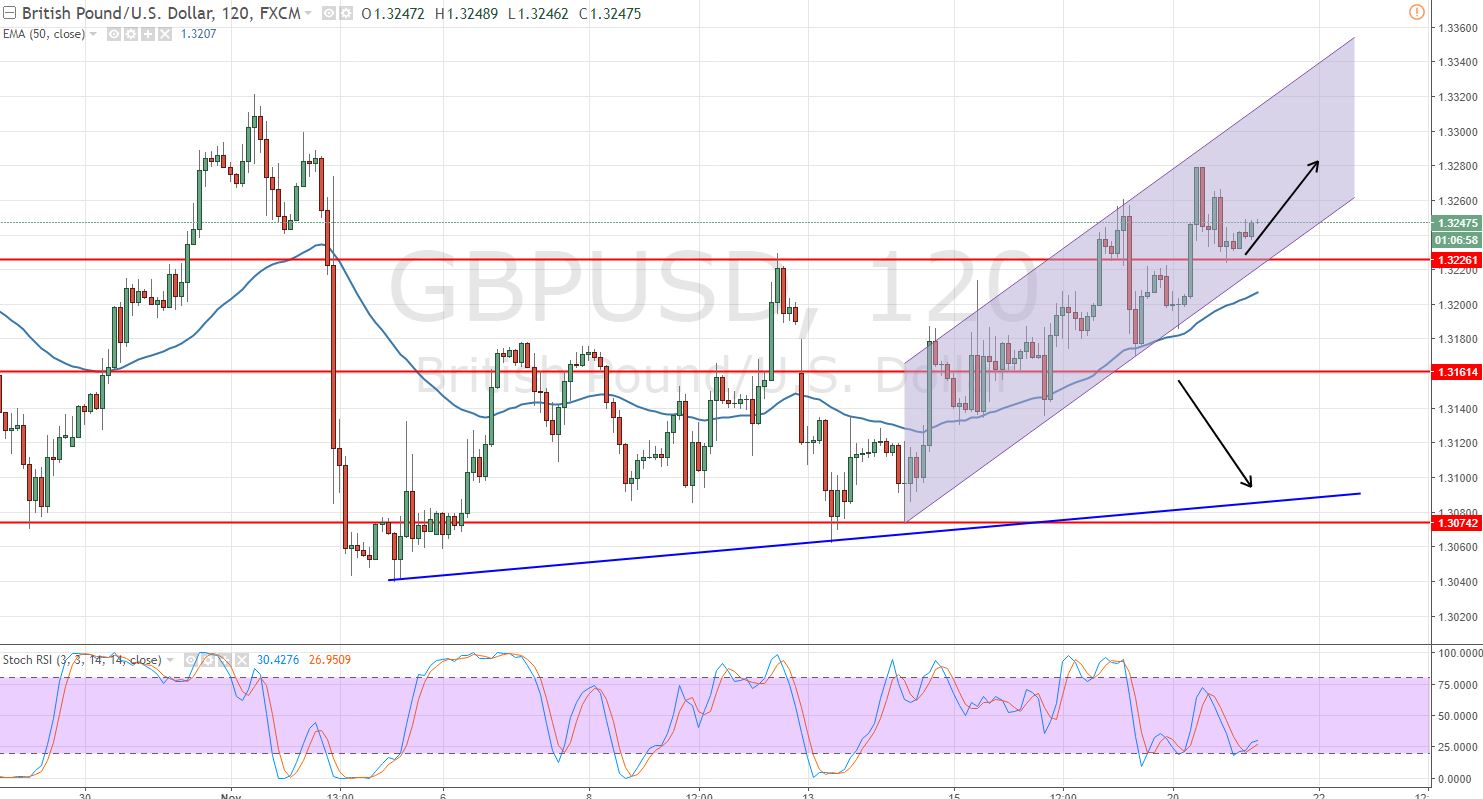

GBP/USD – Pair In Bullish Channel

Slow and steady wins the race. The Sterling is keeping up with its bullish momentum despite the thin trading volume of GBP/USD. The pair is still consolidating in the trading range of $1.3175 – $1.3270.

GBPUSD – 2-Hour Chart – Bullish Channel

GBPUSD – 2-Hour Chart – Bullish Channel

The leading indicator Stochastic has started coming out of the oversold zone which means the bulls are entering the market. So, why should we stay out of the market? Let's move towards the trading plan.

GBP/USD – Key Trading Levels

Support Resistance

1.3186 1.3279

1.3139 1.3325

1.3093 1.3372

Key Trading Level: 1.3232

GBP/USD Trading Plan

I'm looking to stay bullish above $1.3225 with a stop below $1.3200 and take profit of $1.3265 and $1.3280.

We need to be cautious about the UK's inflation report as this is something that could cause some serious volatility. Good luck and have a profitable day!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

EURUSD – 2-Hour Chart – Double Bottom

EURUSD – 2-Hour Chart – Double Bottom GBPUSD – 2-Hour Chart – Bullish Channel

GBPUSD – 2-Hour Chart – Bullish Channel