1.21 Is History for EUR/USD As Everything Falls In Place for the Euro

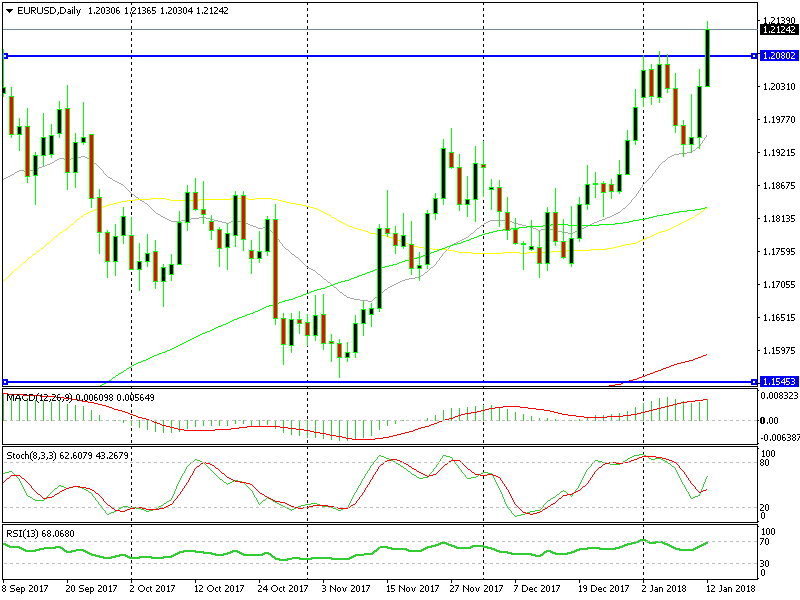

EUR/USD finally broke above 1.21. This has been a major resistance area stretching from 1.2080 to 1.21. It has topped the uptrend twice.

EUR/USD finally broke above 1.21. This has been a major resistance area stretching from 1.2080 to 1.21. It has topped the uptrend twice in August and September last year, but you can’t see it on this chart. If you zoom out the daily chart on your platform you can see that.

The buyers had a few attempts at this level earlier this month but they failed again to break above it. It looked like this level was going to hold again as this pair reversed back down.

But the stars started aligning again buyers and this time it looked as EUR/USD was going to break the 1.21 level. Yesterday, this pair jumped for about 130 pips from the 1.19 lows which took us close to 1.21 again.

I said that we might give the 1.21 a try on the short side yesterday, but this latest move was one jump too many. When the price keeps coming to a resistance level often, then the chances are that it will be broken sooner or later.

The 20 SMA (grey) did a good job in providing support this week

Technically, the break doesn’t make much sense. But as I said, the stars aligned for this pair as everything went in favour of the Euro and against the USD recently.

China is thinking about stopping the purchase of US treasuries, the ECB (European Central Bank) minutes showed that the rhetoric will get more bullish and the US producer inflation yesterday was really disappointing.

So, the price turned around yesterday just above the 20 SMA (grey) on the daily chart and EUR/USD headed for 1.21, as we mentioned yesterday. Now, the 1.2080-1.21 will turn into support if this pair slides lower.

We might give it a try on the long side with a short term buy forex signal if the price dips down there today, so hang around guys. The stop would be below 1.2080, obviously, but let’S wait for the retrace first.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account