Moving Averages Have Formed A Resistance in EUR/USD

EUR/USD made quite a reversal yesterday which continued this morning as well. This forex pair climbed higher from below 1.2280 to above 1.23

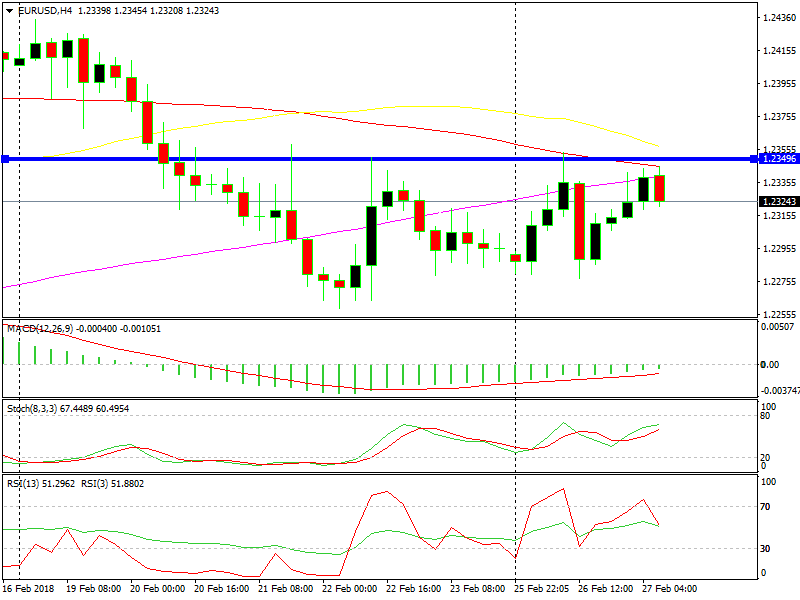

EUR/USD made quite a reversal yesterday which continued this morning as well. This forex pair climbed higher from below 1.2280 to above 1.2340. That seemed slightly bullish but the old level at 1.2350 is being a tough nut to crack for EUR/USD bulls, once again.

There are two MAs providing resistance at 1.2250s

The area around 1.2350 has formed a resistance band. You can see the resistance line (blue) but the main indicators there are the two moving averages. The 100 SMA (red) and the 200 SMA (purple) have stopped the climbs and reversed the price quite a few times in the last week. They’re still standing up there and they reversed EUR/USD lower again today.

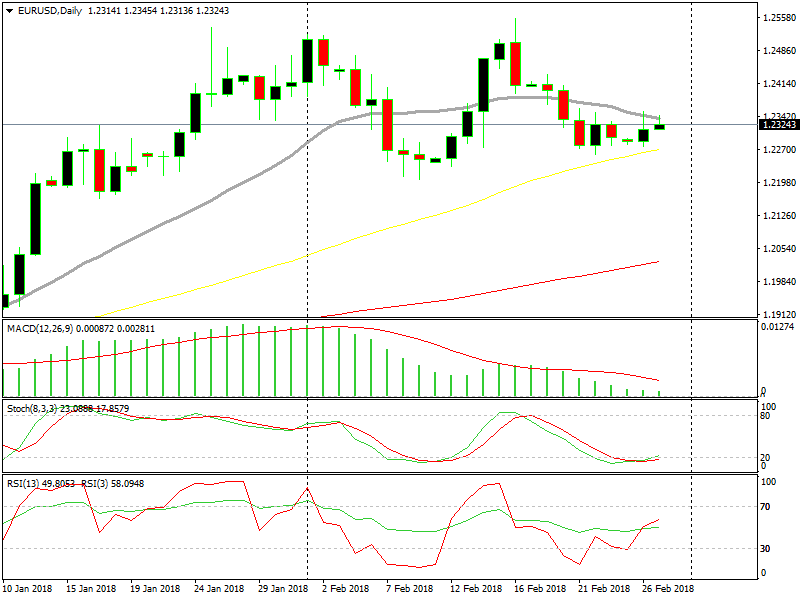

The 20 SMA is doing the job on the daily chart

Switching to the daily chart, we can see the 20 SMA (grey) is standing around the same level as well. This moving average used to be support previously on the way up. But, it was broken to the downside in the first week of this month and now it has turned into resistance.

As you know, we really like moving averages because many forex traders use them, so they work pretty well. They have formed a srong resistance level at 1.2350s, so if you are a EUR/USD seller, this is the place to look for shorts.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account