We just opened a sell forex signal in GBP/USD. I was thinking about shorting EUR/USD, but that forex pair has made quite a reversal from the lows yesterday, so we decided to stick to GBP/USD.

First of all, GBP/USD is showing signs of weakness. While EUR/USD is near the lows of the last several days, GBP/USD is about 100 pips below yesterday’s high. This sort of price action looks bearish.

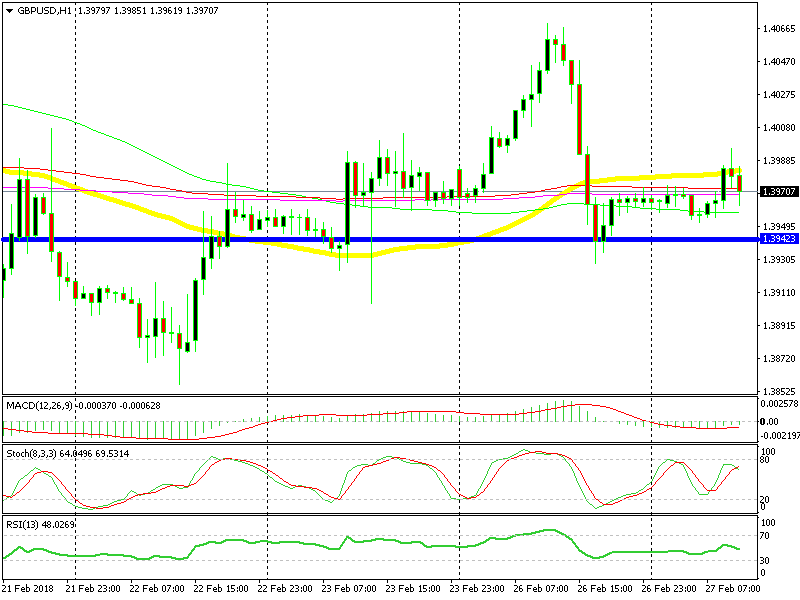

But, the main reason that we went short on this forex pair is the big level at 1.40. That is a major level. While it has been breached many times above and below, it still acts as support and resistance. As you can see form the h1 chart below, the area around 1.40 has been providing resistance for about a week, apart from yesterday when USD sellers sent this pair higher.

The big resistance level at 1.40 is working today

Besides the big level, we have the 50 SMA (yellow) which is standing just below it. That moving average is doing whatever it can to reverse this pair lower and it seems like it is working.

Another bearish signal is the previous hourly candlestick. As you can see, it formed a doji just below the 50 SMA. The doji is a reversing signal according to the candlestick trading strategy. So, according to these indicators, we decided to go short on GBP/USD.