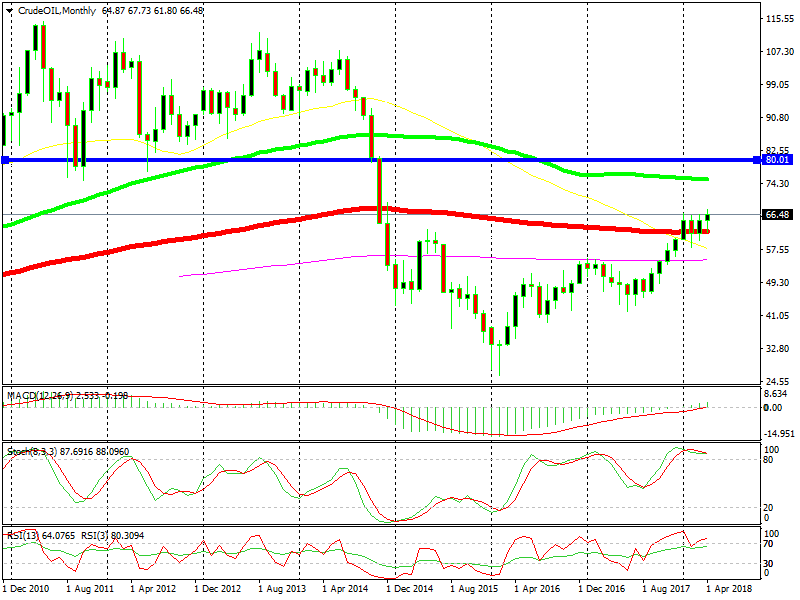

What Are the Odds of Oil Reaching $80 This Year?

Yesterday, I came across a question in a social platform which weighs odds of future events happening one way or the other. The question was “Will Oil reach $80 sometime this year?”. You identify and weigh the pros and cons and you come up with the odds. But before answering that question there, I think I’m going to give it a try here first.

The red moving average has been broken

Pros

- World economy is improving with more pace

- OPEC is keeping the quotas

- $80 is not that far

- The trend is bullish

Cons

- $80 is quite far

- The trade war is beginning with tariffs

- Real war is just around the corner in the middle east

So, how do we weigh these factors?

Pros

- Real, it’s been going on for some time

- Real, OPEC will push quotas further

- Real, $80 is not far, it’s reachable

Cons

- Real, $80 is a bit far

- Partially real, trade war has begun but we don’t know to what extent it will stretch. Will it hurt the global economy, or will it give it a push? It’s too early to tell and things are very blurry.

- NATO launched a few missiles

- The trend is bullish, isn’t it?

As you can see the odds of Oil reaching $80 are 50/50. I don’t have a programme to weigh the odds correctly, but that’s the idea. The chances of Oil reaching $80 are almost the same as not reaching that level. The 100 SMA (green) is likely to be a big obstacle, but if the momentum is strong, then it can be overcome.

Conclusion – I give it 60% chance that Oil prices reach $80 this year.