5 Types of Forex Strategies That Work

There are countless forex trading strategies out there. But, only some of them actually work.

If you search the internet for forex trading strategies, you will notice the hundreds (if not thousands) of indicators and strategies. However, not all of them work. In fact, only a small number of strategies and indicators really work. The more complex and fancy a strategy is, the less likely it is to work.

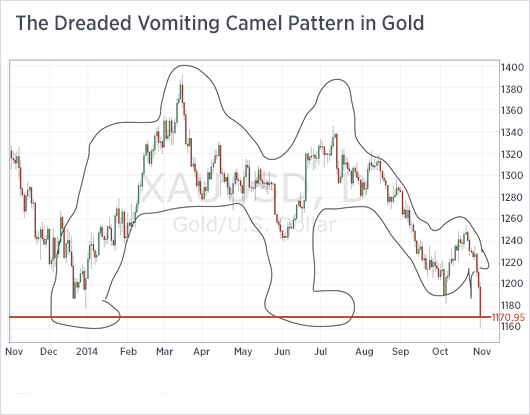

Among the many forex trading strategies, there are some really silly ones. We highlighted the funniest example on Fxleaders.com. There is a trader who likes to draw strange animals on charts and post them online. Then, a Bitcoin trader, who I suppose is new to trading, (probably just started when Cryptocurrencies were surging in December 2017), posted a video of some charts. This guy had taken the joke seriously and was explaining this strategy, which isn’t really a strategy. That “forex trading strategy” is called the “vomiting camel”. So, this trader was explaining the vomiting camel strategy and what was funnier was how serious his face was.

So, it is compulsory for us as traders to filter out the forex trading strategies that don’t work and pick the best strategies. Now, don’t expect the strategies to work 100% of the time. Trading forex is not an exact science like maths. It is more like a social science. You won’t find the Holy Grail, but there are some strategies that work better than the rest.

Trading Moving Averages

Let’s start with moving averages. As logic suggests, the strategies that are broadly used are the ones that work best, since everyone uses them. Big round numbers are the best, so I use the 20 Simple MA (grey), the 50 Simple MA (yellow), the 100 Simple MA (green), the 100 Smooth MA (red) and the 200 Smooth MA (purple).

Moving averages make forex trading easier in different ways. They define the trend, define the ranges often, and provide support and resistance.

MAs take each other’s place in providing support and resistance

When the price of an asset traces below the moving average, then we are in a downtrend. When it moves above, then we can assume that the trend is changing. This means we can buy long as the price stays above the moving average. The moving averages above are the best for this. You can see the trend started to change in EUR/CHF as the price moved above moving averages one after the other.

Once the 100 Simple MA (green) was broken to the upside, the trend picked up the pace. Why? Because forex traders saw the break and decided to increase their long positions. Perhaps, sellers reversed and turned into buyers.

Moving averages are great support and resistance indicators as well. As you can see from the chart above, every dip to the 50 SMA (yellow) has been a great opportunity to buy. When the 50 SMA let go, the 100 SMA (red) took its place. So as you can see, using moving averages to define the uptrend and then buying when the price retraces is one of the best forex trading strategies.

Trading the Market Sentiment

The market sentiment is often the deciding factor in forex. Sometimes, if the market sets its mind on something, there’s nothing in the world that can change the direction of a currency. That’s why we interpret charts and follow the trend, rather than trying to predict the future. As we know, the market sentiment is the momentum of the market.

Trading the market sentiment isn’t difficult, it’s reading it that is difficult. But, there are ways to interpret the market sentiment. One of them is the trend. The trend shows the market sentiment, without regard for other factors, such as fundamental and political events.

Another way to read the market sentiment is to follow the price action closely. When a forex pair is trading inside a range you can’t tell the direction. But you can tell the sentiment by observing the price closely. If the bullish moves are faster than the bearish ones, this shows that traders are willing to buy first and ask questions later. In this case the sentiment is bullish.

Support and Resistance Levels

Support and resistance levels are probably one of the simplest forex trading strategies and one of the best. They don’t need much explanation either. Basically, you buy at support and sell at resistance. For a support or resistance level to be established, it should have reversed the price twice. Although, don’t expect the support and resistance levels to work exactly to the pip. Remember, it is not an exact science. The higher the time-frame of the chart, the more room you should give these levels.

The support and resistance trading strategy is very simple

Once one of the levels is broken, it usually turns into the opposite. If the resistance gives way, then it should turn into support when the price returns. The easiest way to trade such a break is to place a buy order above the resistance which has been broken with a stop loss below it. A confirmation would be nice, such as a doji or a pin candlestick during the pullback lower to the broken resistance turned support.

Trend Trading

Trading trends is one of the easiest trading strategies. I’m not saying it is easy, forex is never easy, but it makes trading a bit more straightforward. Although, we must first make sure that what we are trading is really a trend and not a retrace of the bigger trend.

Usually, I use moving averages to define trends, but from time to time I also use trend lines. Moving averages are more flexible and adapt to fluctuations in the trend, while the trend lines and trend channels are stricter, but they get pierced often. These are called fakeouts.

Buying every dip at the 20 SMA (grey) and holding until the 100 SMA (red) would be the most profitable forex strategy in the above scenario

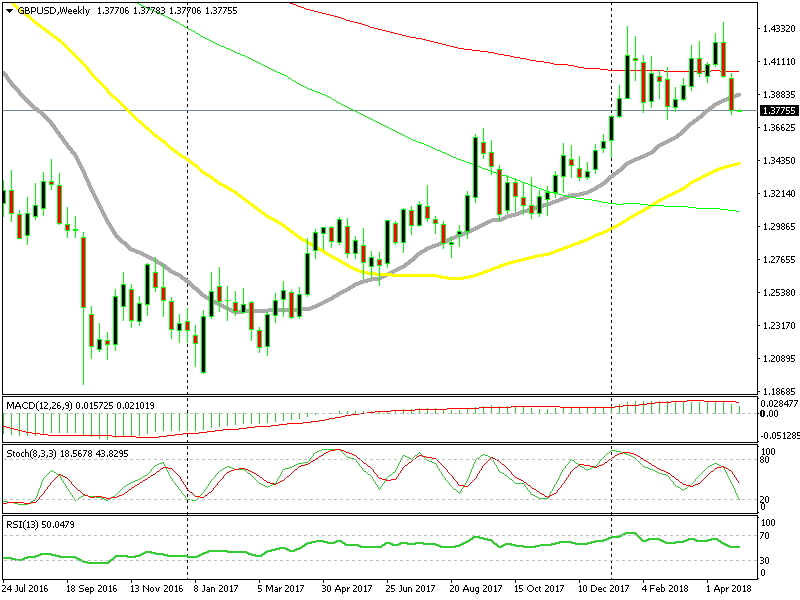

Once the trend is established, you can try a few forex trading strategies. The most obvious one is to get in and ride the entire trend. You enter when you think that a trend is beginning. In the GBP/USD weekly chart above, the uptrend starts when the 20 SMA (grey) and the 50 SMA (yellow) get broken. Normally, I would wait for a retrace to the two moving averages and after getting a confirmation that these two moving averages are holding, I would enter long on this pair.

You can buy and hold for the entire length of the trend or you can buy the retraces and close the trades when stochastic becomes oversold. That’s the indication that the pair is about to retrace lower.

Another forex trading strategy for trends is to add to previous positions. Basically, you enter at the first arrow and keep the trade open. Then when the price retraces lower, you add more to this position and keep adding during pullbacks. This strategy is quite profitable but it is also really risky. If the trend starts reversing down, your profit can evaporate quickly since you’d have several buying positions open.

Trading the Rhetoric of Central Banks

The actions of central banks such as rate hikes, rate cuts, monetary tightening or expansion all impact the market, but only to a certain degree. The market has already priced in the actions way before they happen unless they come as a surprise, which is very rarely the case. So, the rhetoric from central banks takes the second spot in moving the market nowadays, right after politicians.

Trading the rhetoric is not that easy but it can be done even if you are relatively new to forex. You can scalp the major comments. For instance, if Mario Draghi, who is the ECB Chairman, says we will hike interest rates tomorrow by 25 basis points, then you should rightfully expect the Euro to jump 50-100 pips higher. Although, you must trade quickly since the trading algorithms are really fast.

The best way for forex traders is to trade expectations for the rhetoric. When central bankers speak, usually the market has expectations on what they will say. If they meet or exceed expectations then it will set the tone of the market for the next few session or the next few months.

These guys hold immense power in their hands

For instance, right now the market is expecting the ECB to tighten the monetary policy but no one knows when that will happen exactly. If tomorrow Draghi says that the ECB will reverse monetary tightening to monetary easing, then you bet the Euro will surge and a long-term uptrend will commence. In this case, you have time to buy the dips.

If Draghi disappoints or if he implies that the ECB will remain dovish, then the Euro will likely lose considerable ground over the next few weeks. In both cases, you don’t have to be very fast, but you have to know if Draghi met or missed expectations.

Among the countless strategies out there, I would recommend these five as the best forex trading strategies. I am sure you have heard many times of strategies based on support and resistance, moving averages and the others that we have listed above and that’s with good reason. These are the most widely used forex strategies out there, therefore, they work pretty well. If you stick to them and master them, I’m sure you will start seeing the benefits.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account