GBP/USD – The Most Highlighted Pair Of The Day – Quick Technical Outlook

Sterling drop from 1.4375 (high) to 1.3475 (low), which is almost 900 pips. Can Bank of England support pound today?

In the previous three weeks, the sterling dropped from 1.4375 (high) to 1.3475 (low), which is almost 900 pips. The bearish trend, much worse thanexpected, came in response to economic figures of the U.K. and a stronger dollar. U.K’s inflation fell from 2.7% to 2.5 and GDP grew by only 0.1% q/q in Q1 of 2018 which is quite disappointing. But the point to focus on is whether the Bank of England can support pound today?

Technically, the Cable is massively oversold and the daily RSI is holding in the oversold zone since the last week of April. Now, it badly needs to retrace back upwards, though it’s hard for traders to buy sterling until they have some kind of solid fundamental support. In my opinion, the BOE can bereason for a bullish reversal in the pound. But, as discussed in FX Leaders May 10 – Economic Events Brief, the market is expecting BOE to keep the rates on hold.

Anyway, officials from the MPC (monetary policy committee) can support the pound if they want, merely by voting for the rate hike such as 3-0-6 instead of the 2-0-7 forecast.

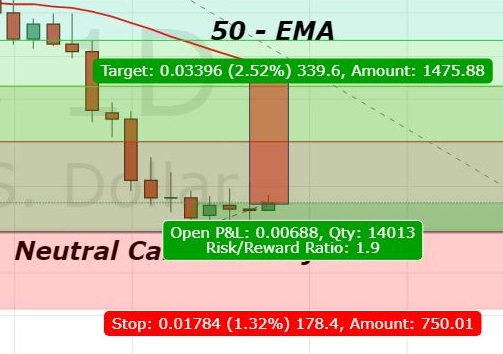

GBP/USD – Daily Chart

Technically, the pair is carrying a bearish trend. The cable has recently gained support above $1.3485, and it has formed a number of doji and spinning top candles which are signaling the neutral sentiment of traders.

The 50 – periods moving average is holding near $1.3965 which means the GBP/JPY should be trading near this level. In case of the hawkish policy decision, the GBP/USD is likely to bounce off above $1.3485 to target 23.6% Fibonacci retracement of 1.3695 today. Whereas, a break below $1.3495 can lead towards $1.3365. So good luck for today and trade with care!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account