Forex Signals Brief for Oct 8: Dollar Trades Bullish Over Sentiments

It’s going to be a fairly light week on the economic calendar and traders will continue to observe the outcomes of rising US government bond yields on market. The US bond markets resume on Tuesday after Monday’s Columbus Day holiday. Recalling FX Leaders Oct 08 – 12: Week Ahead, global financial markets are expected to remain closed in the observance of Thanksgiving Day. Meanwhile, Japanese investors will be celebrating the Health-Sports Day and the US markets will be closed due to Columbus Day.

In the absence of economic events, investors are likely to price in the US employment report. The US economy added 134K jobs last month, though the number for August was updated to 270K from 201K. The annual earnings growth came in at 2.8%, falling from 2.9% in August.

However, the unemployment rate dropped to 3.7% (the 49-year low), down from 3.9% in August.

As you know, between Non-farm payroll and the unemployment rate, the market initially prices in the NFP figure, which in this case was worse than expected and has already been priced in. Now, it’s time to trade the better than the expected unemployment rate. Investors may trade the market on stronger dollar sentiment.

Forex Signal Update

The FX Leaders Team finished the week with 16 winners out of 25, which marks a success rate of 64%. The markets may exhibit a very thin volatility in the wake of the holiday, but it still worth monitoring the technical sides to capture quick pips.

DAX – Ger30 – Active Signal

The German stock market index is still hovering between profit and loss, as the uncertainty over the situation debt and the Brexit is causing a bearish pressure on the index. The Dax has an immediate support at 12,133 and 12,037. The investors may jump in to invest in the oversold index.

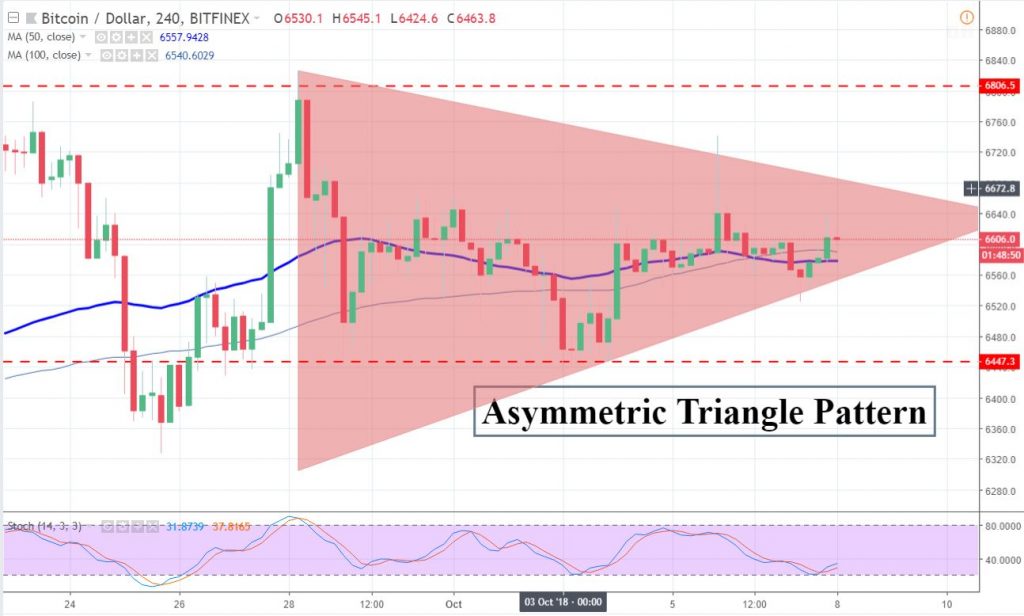

Bitcoin – Active Signal

Bitcoin is still consolidating around the $6,500 level, in an asymmetric triangle pattern. The pattern is representing the neutral sentiment of traders. However, the 20 and 50 periods EMA are still suggesting a bullish trend.