Forex Signals US Session Brief, November 2 – Great Economic From US, Disappointing Numbers From Canada

Today was packed with economic data and I was expecting some good price action in financial markets after seeing only one way traffic in the last couple of days. The US Dollar has been sold off aggressively during this period as the US mid-term elections approach and forex trades fear that Democrats might take the Congress which would make life difficult for President Trump. So, they are closing some of their long positions in the USD

The European session started off with manufacturing reports coming out from the Eurozone and we saw a slight cool off once again in this sector in Europe. This looks bad after the softening of the services sector that we saw in October. The Italian manufacturing performed even worse as the manufacturing production declined. The economic numbers from Canada were pretty soft as well with the annualized earnings slowing down considerably. But, the economic figures from the US were quite upbeat, which gave the USD some much-needed support, although the climb has already stopped.

The European Session

- German Import Prices – In the last two months we have seen some weak import prices in Germany. But, this month, import prices were expected to increase by 0.4% and that’s how today’s number came. Let’s see if it will help CPI inflation later in the year.

- Swiss Retail Sales – Retail sales declined in September in Switzerland but they returned to the positive trend in September. In October, the y were expected to decline by 0.2% but they declined by a massive 2.7%, but the CHF didn’t really mind those numbers.

- Eurozone Manufacturing PMI – The manufacturing number from Europe today were on the soft side. Only Spain showed a pickup in manufacturing activity which increased to 51.8 PMI points against 51.0 expected. Italian manufacturing showed a decline this month, while the PMI indicator ticked lower in Germany and France. The overall Eurozone manufacturing PMI ticked down too, from 52.1 points to 52 points.

- Chinese Economy Negatively Affected by Trade Protectionism – The Chinese central bank PBOC released the financial stability report with comments such as “Trade frictions initiated by the US has brought negative impact to global economy”. They added that China is speeding up opening up its economy.

- UK Construction PMI – The UK construction PMI indicator jumped higher to 53.1 points against 52.0 points expected. This was a bit of a surprise after the soft numbers from UK that we have recently seen.

The US Session

- UK Has Put Forward Proposal on Irish Border – These were the comments by the UK PM spokesperson. He added that the EU is currently working on the proposal, but it would be unacceptable leaving Northern Ireland outside of the UK customs.

- Rumours On US-China Trade Deal Not True – The CNBC White House reports tweeted today that rumours on a trade deal between US and China anytime soon are not true, according to a senior US official. Stock markets turned bearish on those comments, but remains to be seen if his comments are true.

- Canadian Employment Change – Employment increased by 11.2k in Canada against 12.7k expected. That is a long way from the 63.3k increase that we saw last month.

- Canadian Unemployment Rate – Unemployment rate declined to 5.8% in Canada against 5.9% expected. But, the participation rate of the unemployed people claiming benefits declined by 0.2%, meaning that the unemployment rate should have been at 6.0%.

- US Earnings Report – US average hourly earnings came at 0.2%, down from 0.3% previously. But, the year-on-year number increased to 3.1% from 2.8% previously. This is quite a big jump in earnings which gave the USD a lift.

- US Unemployment Rate – The unemployment rate remained unchanged at 3.7% in the US this month. But, the participation rate increased by two points, which means that unemployment should have declined in normal conditions.

- Non–Farm Employment Change – Non-farm employment was expected to increase by 194k in the US but it jumped by 250k. Although, last month was revised lower to 118k from 134k expected which took some off the shine off this month’s numbers.

- US Factory Orders – US factory orders were expected to increase by 0.5% this month, but they came at 0.7% instead. Last month was also revised higher to 2.6% from 2.3% expected, so yet another positive number from the US.

Trades in Sight

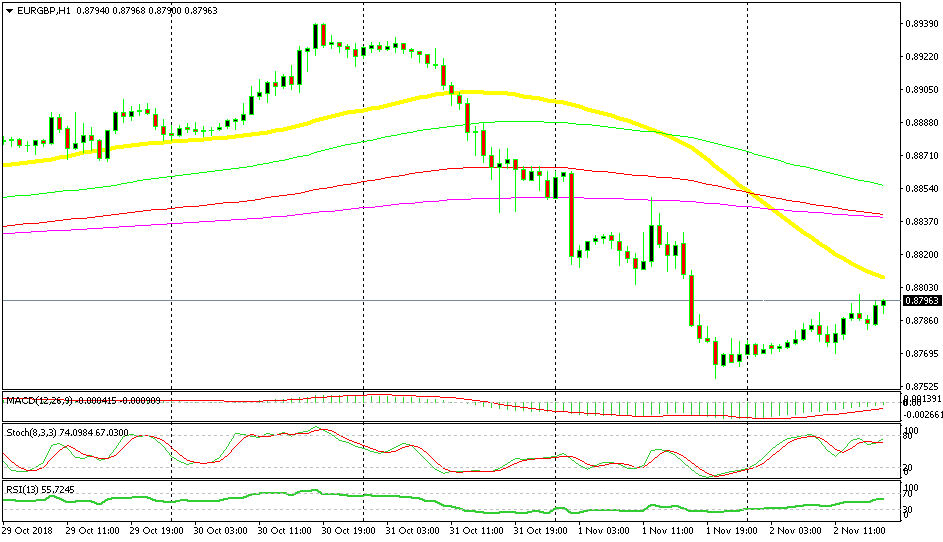

Bearish EUR/GBP

- The trend has turned bearish

- The 50 SMA is catching up

- The retrace is complete on the H1 chart

The 50 SMA is catching up

We decided to sell EUR/GBP a while age as this pair was retracing higher on the H1 chart. The trend has shifted for this forex pair as Brexit rumours suggest that we might get a Brexit deal soon. The retrace seems complete now as stochastic is near the overbought levels. Besides, the 50 SMA (yellow) is catching up and it will likely push EUR/GBP lower when it reaches the price.

In Conclusion

The selloff in the USD seems to have come to a halt now after the positive economic numbers that we saw come out of the US during the US session. But, I think that we might see another wave of USD selling until the mid-term elections next Tuesday. By the way, I was thinking that elections were going to be held during the weekend, so the uncertainty will continue for another two days in the markets.