Forex Signals US Session Brief, November 14 – Finally, a Breakthrough in Brexit Negotiations but the Market Is Skeptical

The US Dollar has been on a bullish run for some time and it picked up more pace after the FOMC statement last Thursday. Although, yesterday we saw a pullback in USD. In fact, it started as a climb in GBP/USD as Brexit comments started coming out in the US session, but then it turned into a broad USD selloff.

If you have noticed, this has happened pretty often recently. When something changes fundamentally for a currency, it starts climbing against the USD and then all the other major currencies start climbing against the Buck, turning it into a USD selling frenzy. That is what happened during the US session yesterday and during some of the Asian session this morning.

So, back to Brexit, last evening many news portals started posting comments about a breakthrough in Brexit negotiations between Britain and the EU. It seems that both parties have agreed on a deal but it is still very confusing since the European Commission and UK government officials are not giving too many details away.

All the confusion is about the Irish border and the backstop. The DUP Party of Northern Ireland is skeptical out of fear that North Ireland might fall under Dublin more than under London, although May is trying to calm the British Parliament down today. So, it is not clear whether the deal will pass the vote in the parliament. As a result, GBP/USD has slipped lower again today. On another note, the Italians have handed out the budget for 2019 barely revised and the EU will take about a week to answer to that.

The European Session

- North Ireland’s DUP Foster Doesn’t Like the Deal – North Ireland DUP Party leader commented that they cannot accept a Brexit deal that leaves them apart from the rest of the UK. She will look into details of the deal. We all would like the details.

- The Irish Like the Deal – The Irish member of the European Parliament Brian Hayes said this morning that they like the Brexit deal. This is a clue that the deal must be favourable for Ireland but it remains to be seen.

- UAE Oil Minister Trying to Talk Oil Higher – The Oil Minister of Arab Emirates said that OPEC+ will do whatever needs to be done to keep the market stable. He didn’t like the $4.50 decline in Crude Oil yesterday. He added that Oil production is above expectations and they will cut production if they need it. Speaking of monopolies…

- German Economy Minister Sees the Economic Halt in Q3 As Temporary – He said that economic expansion was disrupted last quarter by car emission problems which took 0.4% off the GDP. He expects the economy to pick up again, but he should be aware that Trump is preparing auto tariffs for Europe.

- EU’s Malmstrom Plays Her Card Again – Speaking of car tariffs, the EU trade Commissioner Cecilia Malmstrom said that the EU will respond if the US imposes tariffs on European cars. She added that the EU is able to come up with a list of US products to be targeted for tariffs such as agricultural products, cars and machinery.

- UK CPI Inflation Misses Expectations – The main CPI inflation number from UK missed expectations which were for a reading of 2.5% YoY, remaining unchanged at 2.4%. The core number remained unchanged as well at 1.9%.

- Eurozone Q3 GDP – The EU GDP increasd by 0.2% in Q3 as expected and the annualized number came at 1.7%. Industrial production declined by 0.3% against -0.4% expected, but last month’s number was revised higher from 1.0% to 1.1%.

- The Future of the Irish Border to Be Decided in 2020? – A Reuters report said that if no new trade deal is agreed by that time, then the UK can postpone the transition period once. Otherwise, Britain could allow North Ireland to be closer to EU rules and customs.

- Theresa May’s Camp Expects the DUP Party to Support Her – According to Sky’s political correspondent, the British PM expects the DUP Party of Northern Ireland to fall in line when they vote on the Brexit deal today, when they see the final terms. I wonder.

The US Session

- No Rerun of Brexit Referendum for May – Theresa May said a while ago that they will not hold another Brexit referendum. The Brexit deal delivers on the vote of the people, she adds, and she is keeping the promise of a vote in the Parliament.

- US CPI Inflation Report – The US CPI (core price index) increased by 0.3% month-on-month as expected while core CPI increased by 0.2%. Year-on-year CPI increased to 2.5% against 2.3% previously but core CPI came at 2.1% against 2.2% expected. A positive inflation report overall.

- Irish PM Wants the Backstop – The Prime Minister of Ireland Theo Vadarkar said that if the backstop is applied, then it should remain until a broader agreement replaces it. This goes against the interest of Brexiteers so we will see if the deal passes in the UK parliament.

Trades in Sight

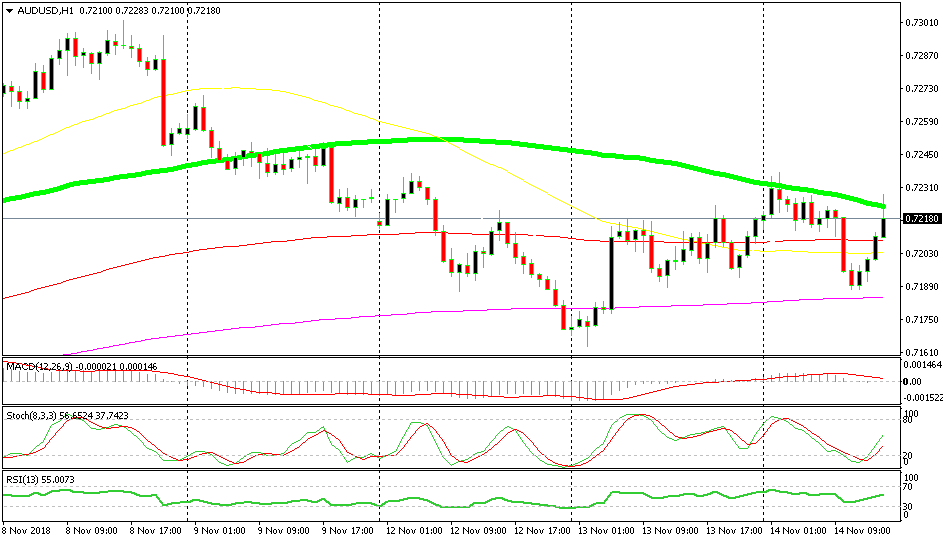

Bearish AUD/USD

- This pair turned bearish last week

- The retrace up is almost complete

- The 100 SMA is providing resistance

- Fundamentals are bullish for the USD

The 100 SMA is not giving way

We just opened a sell forex signal in AUD/USD. This pair turned bearish last week after the FOMC statement and it has been sliding lower since then. We saw a retrace higher yesterday and again today, but the 100 SMA (green) provided solid resistance. Now, the stochastic is almost overbought so the retrace is almost complete and the US CPI report was positive, which should support the USD.

In Conclusion

So, we finally have a Brexit deal but it is not over yet. It has to go through the parliament first and it seems pretty difficult for Theresa May to get the votes she needs. The US CPI inflation report was positive today, which should keep the FED hawkish on interest rates.