US Session Forex Brief, Dec 17 – The Euro Remains Bid Despite Weak Eurozone Inflation Figures

This week we have plenty of economic events scheduled for release in the economic calendar due to Christmas, but not today though. The main economic calendar today was the consumer price index (CPI) from the Eurozone. I was expecting some increased activity in the Euro pairs during the release of the inflation report but nothing extraordinary happened. In fact, EUR/USD only jumped around 20 pips after the inflation report came out.

That was another strange thing though since inflation numbers were pretty soft. Inflation declined 0.2% in November as expected while core inflation, which leaves out food, energy, alcohol, and tobacco, declined by 0.3% against -0.2% expected. The Year-on-Year CPI number slipped to 1.9% against 2.0% expected but the YoY core inflation remained unchanged at 1.0%. Considering these numbers, the Euro should have declined lower and resumed the bearish trend. But it did the opposite. I suppose the market was expecting weaker numbers because we have seen some really bad figures regarding the Eurozone economy recently and they have only been been getting worse.

Anyway, we will see if next month’s core inflation will hold at 1.0% which is the minimum target from the European Central Bank. The minimum target for the YoY headline CPI is at 2.0%, which is now broken to the downside, but the core number is more important right now. There is a meeting at the World Trade Organization (WTO) today as well and from what we have heard so far, the US and Chinese delegations are having a row there which is denting the market sentiment, thus offering some bids for the JPY and Gold.

The European Session

- Italian Are Accepting the EU Hegemony – There was a report in Bloomberg early this morning that the two Italian Deputy Ministers Salvini and Di Maio have reached an accord with Prime Minister Giuseppe Conte about the deficit which looks like is going to be around 2%, against 2.4% that Di Maio and Salvini would have preferred. Ansa reported a while ago that the deficit would be at 2.04% of the GDP for next year. Meanwhile, the French Finance Minister Le Maire said that the French deficit will be as close to 3% as possible, having lowered it from 3.4%. But, the Italian economy is pretty weak right now so the deficit compared to GDP will likely surge to 2.8-3.0%, which is why the EU wants a lower deficit for Italy.

- Brexit Saga – Eurozone inflation report came out pretty soft today apart from core YoY CPI which came as expected at 0.1%. Headline YoY inflation ticked lower to 1.9% from 2.0% previously, while core inflation for November came at 0.3% and headline CPI came at -0.2%. Although, the Euro jumped higher nonetheless.

- Eurozone Inflation – The consumer price index (CPI) declined by 0.1% in Spain as anticipated and the HICP declined by 0.2%. Although, the annualized numbers for both these inflation indicators remained unchanged at 1.7%.

- Slower Growth in October Than the IMF Had Anticipated – Well, no surprise there. IMF said that trade tensions had impacted sentiment in the global markets, particularly the Asian and the Chinese economies. Although, it might be getting better now after the G20 summit.

- US and China Have A Go at Each-Other at the WTO – There is a meeting at the World Trade Organization today and the delegations from the two giants are clashing again after the truce at G20 summit. US envoy said that China’s approach to economy and trade is incompatible with WTO. The Chinese responded that the US should help fix the WTO instead of trying to dismantle it.

- Incoming ECB Member Looks Dovish – Pierre Wunsch will be the new ECB member next January and he said that if the Eurozone economy slows more than expected, then they can delay rate hikes further. He added that the data will dictate the path. Those are some dovish words but the market wants confirmation from Chairman Draghi.

The US Session

- Donald Trump Tweets on Rate Hikes – The US President Donald Trump doesn’t like when the FED hikes interest rates and the FED will hike them again on Wednesday. He has made his intentions known on that as he just posted a tweet about it. Here is the tweet: “It is incredible that with a very strong dollar and virtually no inflation, the outside world blowing up around us, Paris is burning and China way down, the Fed is even considering yet another interest rate hike. Take the Victory!”

- US Empire State Manufacturing Index – US Empire State manufacturing index has increased to 23.3 points in November. Today it was expected to cool off once again and fall to 20.1 points, although it was slashed in half as it came at 10.9 points. That shows that the manufacturing is going through a soft spot this month.

- US NAHB Housing Market Index – The NAHB housing market index has been holding steady at 67-68 points in the last several months, although it suddenly declined to 60 points in November. It is expected to tick higher today to 61 points, but don’t rule out another surprise.

Trades in Sight

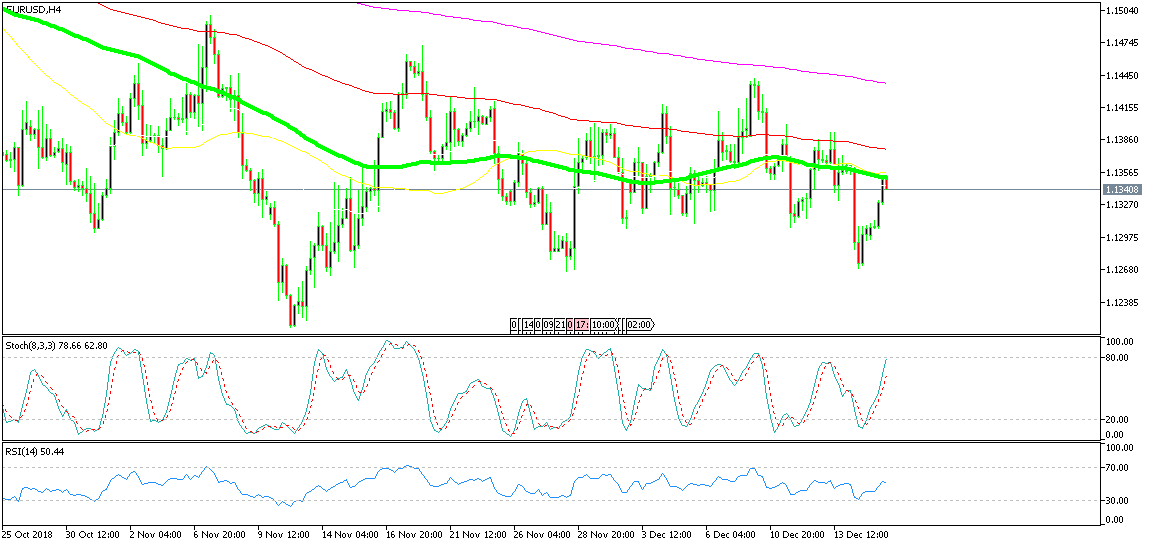

Bearish EUR/USD

- The trend has been bearish for EUR/USD

- It picked up pace last Friday

- The retrace higher is complete

- The 100 SMA is providing resistance

The 100 SMA is providing solid resistance

We opened a sell forex signal in EUR/USD earlier today after the jump over the Eurozone inflation report. But, the main trend is still bearish for this pair and last Friday the downtrend picked up pace as EUR/USD tried the support after losing around 70 pips that day. Today, the retrace higher looks complete as stochastic is almost overbought. Besides, the 100 SMA (green) has been providing resistance for hours on the H4 chart. On the H1 chart, you can find other moving averages at that level which are providing resistance and I don’t think the buyers have enough strength to break above it, so the downtrend should resume soon.

In Conclusion

The safe haven assets have received a boost from the softer US Empire State manufacturing index and Gold has jumped around $4 higher while USD/JPY has lost around 30 pips as the market sentiment turns negative. The row between China and the US at the World Trade Organization have done their damage as well, so be careful with safe havens during the US session, fellas.