US Session Forex Brief, Jan 9 – Sentiment Turns Mildly Positive on US-China Trade Talks

Just like yesterday, the financial markets have been quiet again today, probably waiting for the FOMC meeting minutes which will be released this evening. What’s different today is that the sentiment has turned mildly positive which can be observed in the commodity Dollars which have been crawling higher during the Asian and the European session. The climb in the CAD is another matter since it is following crude Oil prices higher. US WTI crude continues its bullish reversal and it has finally broken above the $50 level today.

The improvement in the market sentiment is due to the positive tones from the US-China meeting. Officials from both countries are having talks on trade and it seems that they have reached some common ground. They will release the statements at the same time tomorrow to avoid the confusion that followed Trump-Xi meeting in the G20 summit about a month ago.

The Aussie is a double winner on a trade agreement because the sentiment will improve and risk currencies such as the AUD gain on positive sentiment. At the same time, that would be good news for the Chinese economy which is in trouble right now, and consequently for the Aussie.

Another highlight during the European session today was the decline in the unemployment rate in the Eurozone as well as in Italy. Eurozone unemployment lost two points falling to 7.9% and the Italian unemployment rate ticked lower too. Stock markets continue to grind higher again today as well as USD/JPY, while GOLD is reversing lower, which means that safe havens are in a bit of a trouble.

The European Session

- Swiss CPI – The consumer price index turned negative in November in Switzerland, declining by 0.3%. In December, CPI inflation was expected to decline again by 0.2% but it missed expectations, coming at 0.3% today. So, inflation is heading lower in Switzerland, just like in the rest of the EU.

- NI DUP Party Doesn’t Accept the Backstop – Theresa May’s governing partner, the DUP Party of Norther Ireland, commented today on the Irish backstop saying that proposals on the backstop are meaningless. The only deal that could change their stance is a deal without the backstop and there’s no reason to fear leaving without a Brexit deal.

- Italian Unemployment Rate – The unemployment rate in Italy jumped higher to 10.1% in September from 9.7% previously and it jumped again to 10.6% in October. Today’s report which is for November was expected at 10.5% and unemployment ticked lower to 10.5% as expected. It’s not much, but it’s a step in the right direction.

- Eurozone Unemployment Rate – The unemployment rate for the Eurozone declined by 2 points to 7.9% from 8.1% previously. Although, last month’s number was also revised lower to 8.0%. Let’s see if this will translate into higher wages and inflation as ECB officials suggested.

- US-China Meeting Concluded – The meeting between these two giants is finally over. Reports from the media suggested that trade talks were conducted in a pleasant and candid atmosphere and both sides will release message at the same time on Thursday morning Beijing time.

- Theresa May Comments on Brexit – British PM May commented a while ago, saying that the Parliament will have a vote on implementing backstop. She added that lawmakers will know of EU assurances on backstop before vote, but I still think the UK will crash out without a deal.

The US Session

- FED’s Bullard Doesn’t Want More Rate Hikes – James Bullard of the Saint Louis FED branch commented a while ago saying that interest rates are in the right place and no more hikes are warranted now. He made some more comments on the economy which we will cover after we post this brief, but the tone is dovish and that sent the USD around 20 pips lower.

- US MBA Mortgage Applications – US MBA mortgage applications grew by 23.5% in the first week of this year, after having declined by 8.5% in the previous week. Purchase index came in at 255.5 against 219.0 prior, market index came at 362.7 vs 293.8 in the previous week, while refinancing index increased to 987.9 from 729.9 prior.

- Trump Can Use Emergency Funds for the Wall – The White House spokesperson Sarah Sanders said a while ago that the national emergency funds are still an option for funding the wall in the border with Mexico. The Government shutdown continues and it is turning into the longest shutdown in US history.

- BOC Meeting – The Bank of Canada will hold its meeting in about an hour. They are expected to keep interest rates on hold at 0.75% so the press conference will take all the attention. Trade deficit widened further in Canada as yesterday’s report showed and the economy has weakened, so let’s see what the BOC has to say about it.

- FOMC Meeting Minutes – Later in the evening, we will get to see the minutes from the last FED meeting. The FED softened the tone regarding rate hikes for this year and today Bullard said that the monetary tightening is enough for now, so the market will be very interested to hear what they discussed in that meeting.

Trades in Sight

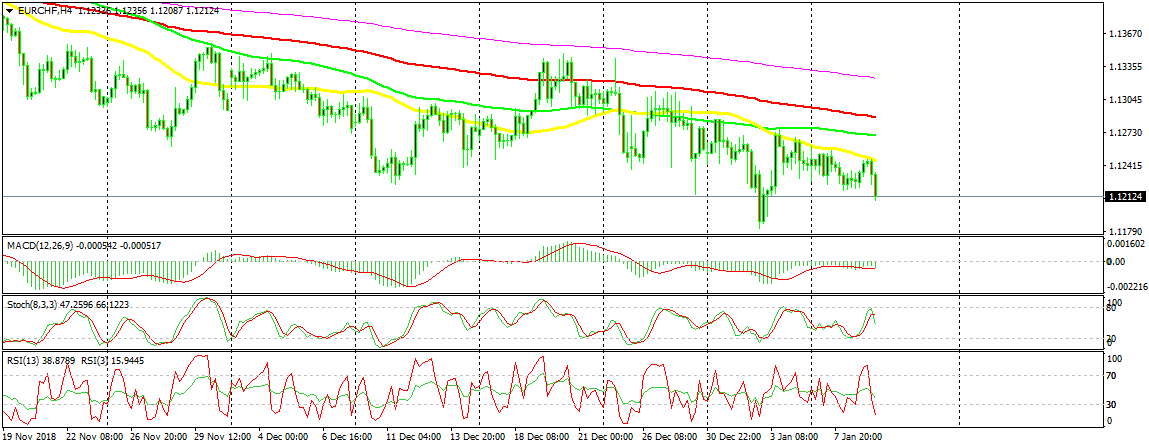

Bearish EUR/CHF

- The trend is bearish

- the 50 SMA provided resistance

- The Stochastic is turning down

The 50 SMA providing solid resistance again

EUR/CHF has been on a downtrend for a few months now but it made a bullish retrace higher during the Asian session last night. Although, it couldn’t overcome the 50 SMA (yellow) which has been providing strong resistance to this pair since last week. The price formed a small doji on the H4 chart below that moving average and stohastic was overbought, which means that the chart setup was pointing to a bearish reversal. The reversal is now underway, but the selling opportunity is still on for this pair if you want to trade it.

In Conclusion

The market is in a bit of a limbo right now as we wait the Bank of Canada announcement to come out. But, the reason for this is mainly because of the FOMC minutes later on as well as the statement that the US and China will release tomorrow regarding the trade talks.