38% Fibonacci Support In Play For Gold

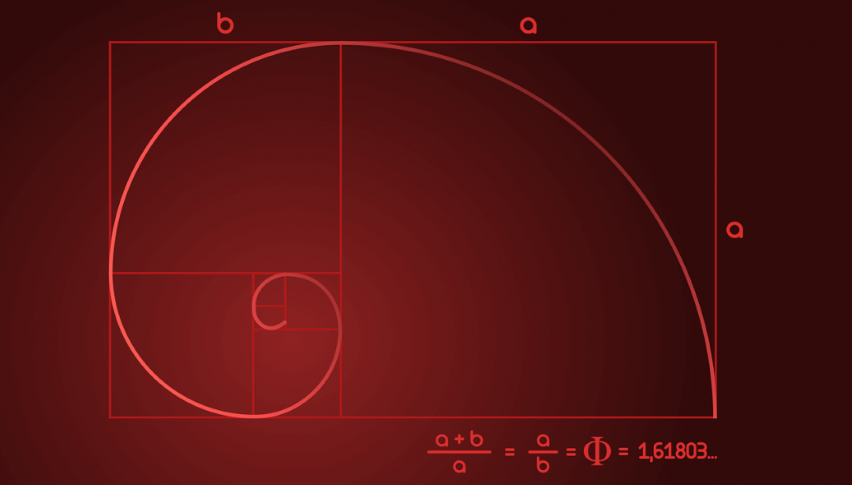

At this point, the uptrend in August gold remains valid. Prices are holding firm near the 38% Fibonacci support level (1427.8).

As we approach the mid-U.S. session, tight ranges are the rule as traders get back behind their desks from the weekend break. At press time, August gold futures are trading within a modest 78 tick range, very near a key Fibonacci support level.

Thursday and Friday of last week brought extreme volatility to gold. Stimulus-oriented comments from NY FED President Williams sent traders to their screens in droves, producing whipsaw trading conditions. Now, prices are tight and downside support at the daily 38% Fibonacci retracement is in play.

Fibonacci Support Proving Valid For August Gold

Amid a wide-open economic calendar, the gold market is in a relative holding pattern. Prices of the August futures contract are in consolidation near the 1427.0 handle.

++7_22_2019.jpg)

Here are the levels to watch for the remainder of the session:

- Support(1): 38% Fibonacci Retracement, 1427.8

- Support(2): Daily SMA, 1410.9

Overview: At this point, the daily uptrend in gold remains valid. Prices are holding firm in the neighborhood of the 38% Fibonacci support level (1427.8). As long as this area is in play, then a bullish bias is warranted.

Although GOLD is currently becoming compressed, don’t get too used to the tight action. This week brings several key economic events and very likely a move in bullion. With a bit of luck, we will get a chance to buy in from the Daily SMA or sell the Spike High in the near future. Stay tuned for details on how to get in on the action as the week unfolds.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account