Crude Oil Continues With Sideways Movement – Quick Update

WTI crude oil prices were down more than 3% earlier this week due to China supported the Chinese Yuan to drop to its lowest level in a ten-y

WTI Crude Oil prices increased despite tensions surrounding the United States and China trade war. Today during the early Asian market, WTI crude oil prices touched the bullish track despite uncertainties around the intensifying trade concerns between the United States and China that could leave a negative effect on crude oil prices. US Crude Oil WTI Futures increased 1.1% to $55.21.

The point is that the People’s Bank of China set the Chinese Yuan stronger on the day which was cited as a tailwind for oil prices today gave some support to investors, while the market is now expecting that a trade agreement might not be reached as soon.

WTI crude oil prices were down more than 3% earlier this week as China supported the Yuan to drop to its lowest level in over ten years against the greenback. On the other hand, China gave an order to state-owned organizations to delay imports of United States’ agricultural products.

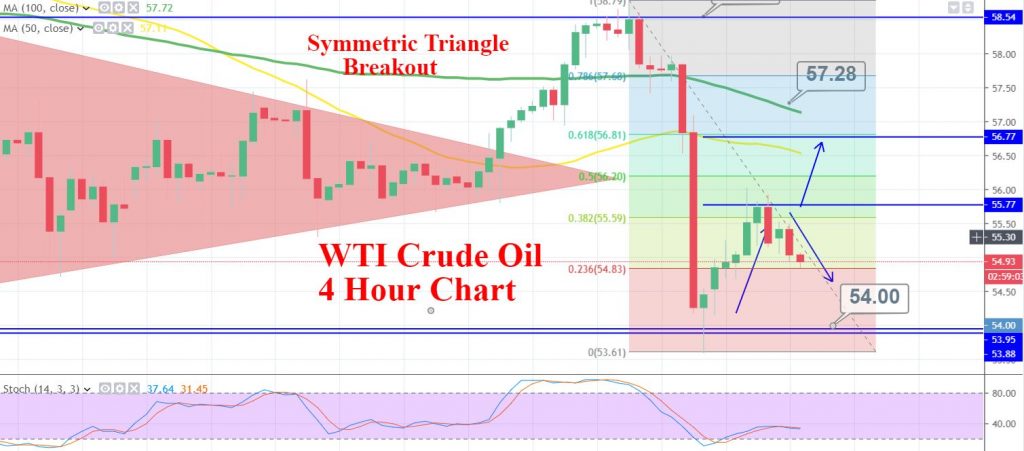

WTI Crude Oil – Technical Outlook

On the technical side, crude oil is slightly bullish at $55.07 and it may head towards the $55.60 resistance area which marks the 38.2% Fibonacci retracement level. Below this, we may see oil falling towards $54.85 support. While, the bullish breakout of this level could extend buying until $56.77, the 61.8% Fibo level.

Support Resistance

54.59 55.94

53.98 56.68

52.63 58.02

Key Trading Level: 55.33

WTI Crude Oil – Trade Idea

The idea today is to stay bearish below 55.45 with a stop loss over 55.95 and take profit around 54.70 and 54.

Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account