Forex Signals Brief for Aug 8: Wall Street Remains on Edge

It has been another wild week so far for markets and it is very clear that many investors remain on edge.

It has been another wild week so far for markets and it is very clear that many investors remain on edge.

Yesterday, the signs were very obvious that there is still plenty for them to be nervous about. While there were no major headlines to suggest anything had changed, they let their money do the talking.

There were more flows into safe-haven assets such as GOLD which is seeing a huge push and is currently valued at $1500 p/ounce. At the same time, there is demand for US bonds. Yields have fallen sharply and yesterday they tagged the 1.60% handle before bouncing sharply.

Meanwhile, the USD remains somewhat steady, as it gets pulled in different directions. It too has some safe-haven appeal, but given the trade wars with China, it too has been on the nose with investors.

What this all means that it is still sentiment that remains the key driver at the moment. And when that is the case it is a great opportunity for traders to cash in on some extended moves in either direction.

Forex Signal Update

The FX Leaders Team finished with 5 wins from 5 signals in a great example of how to make the most of volatile conditions.

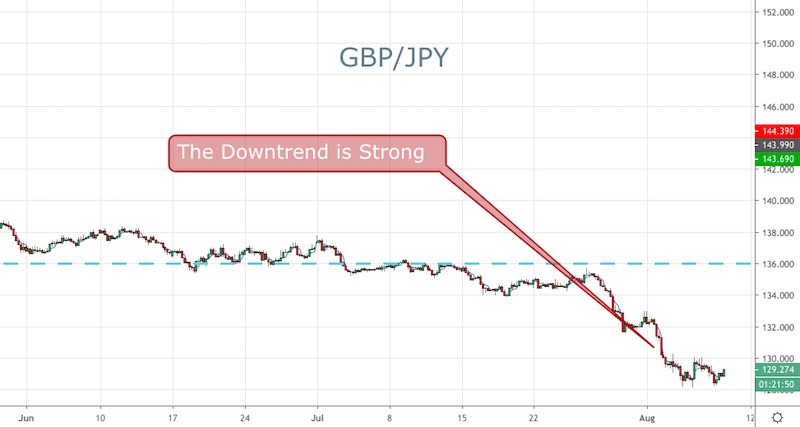

GBP/JPY – Pending Signal

The GBP/JPY remains weak, being underpinned by demand for the JPY. We are waiting on a break of the lows here for a potential leg lower and a short signal.

Gold – Pending Signal

GOLD has continued its bull run and has taken out $1500. As I spoke about earlier today, there is room for more upside here, but we need to see this current resistance level break. So far it is touch and go and we are due for a retracement.

Cryptocurrency Update

BTC failed at its first attempt at the $12,000 level, but looks like it is starting to coil below and might be on the verge of another run.

From a purely technical perspective, we see this type of price action quite a bit. After a big run, resistance is likely to hold as the move is very overextended. But after a pullback, the buyers continue to bid it up and that leads to the next leg higher.

Today it will be well worth watching to see if $12,000 can break and hold and that might bring back the buyers and push price up another leg.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account