Forex Signals Brief for Aug 14: Euro GDP in Focus

Markets might have been lifted by US President Trump winding back his China tariffs yesterday, but there might be more worries in Europe today as we take a look at some GDP figures.

As recently as last week, we saw the UK creep towards the edge of recession territory and now there is another European powerhouse that is starting to look equally as shaky.

The expectation today is that Germany will post negative growth, both on the quarter and the year and this is a very worrying sign for what is meant to be the powerhouse of Europe. At the same time, we also get Eurozone GDP which is expected to post a positive result, in one win for the region. Albeit a very small one.

As a result, the EUR/USD could be in for a wild ride today as well as the GBP/USD which will be getting CPI released. As I mentioned, we’ve had some poor data out of the UK recently so today’s CPI print will be important. In reality, the numbers aren’t too bad and sit just below the BOE’s target band with 2% being the lower end of what they’d like.

While sentiment might have been positive yesterday, things can change quickly so be on the lookout for any weak numbers here as the sellers will likely come thick and fast.

Forex Signal Update

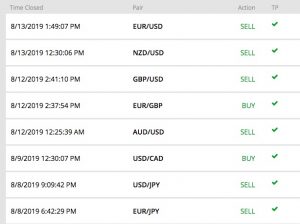

The FX Leaders Team finished with 2 wins from 2 signals and at the moment we are on a nice winning streak with eight straight winners.

NZD/USD – Active Signal

The NZD/USD has been pushing our way but has slightly retracted on yesterday’s Trump headlines. The good news was the bounce wasn’t that big, suggesting the sellers remain in control here.

AUD/USD – Active Signal

The AUD/USD was the strongest performer yesterday, but importantly has not been able to break the 0.6800 level. We are short looking for more downside and we’ve already seen some bearish Chinese data help our signal.

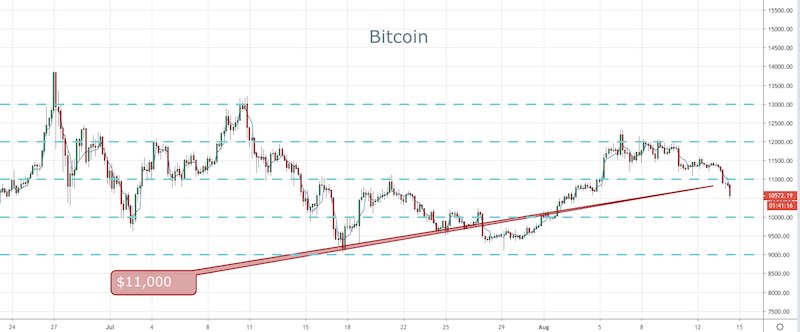

Cryptocurrency Update

BTC has fallen away sharply over the last few hours and is now below the key $11,000 level.

I mentioned earlier today that the $12,000 just remained too strong and the sellers hit it hard on every attempt. When the news filtered through that Barclay’s was dropping its relationship with major crypto exchange Coinbase, the sellers piled in.

I am now fully expecting a test of the major support level at $10,000 in the coming days.