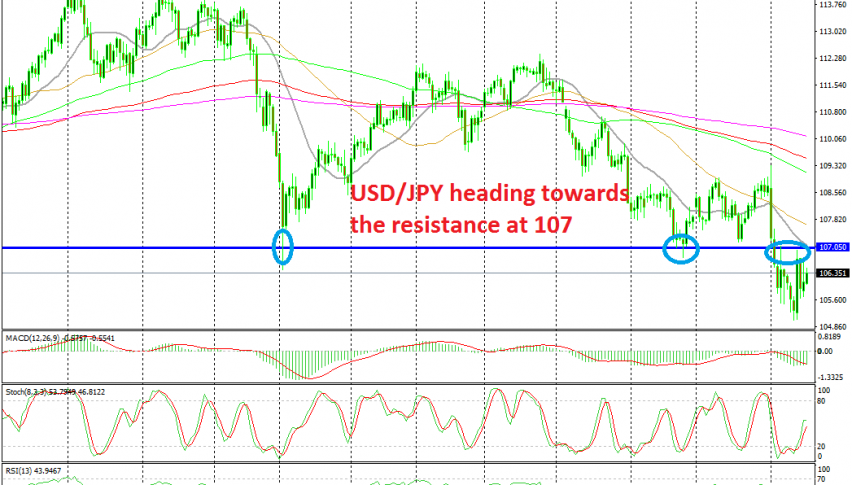

USD/JPY Heading for Resistance Again at 107

USD/JPY has been on a bearish trend since the end of last year. Although this pair took another dive at the beginning of this year when it slipped form 109 at the top to 105 lows in the first week of August as the sentiment deteriorated in financial markets after Donald Trump announced new tariffs on China.

We saw two pullbacks higher this month, one in the first week and one last week when USD/JPY climbed to 107. But, the buyers couldn’t reverse the trend since the sentiment remained negative. So,the 107 level turned into a resistance level for this pair.

Today the risk mood seems to be positive, with commodity currencies climbing higher slowly, while safe havens are slipping lower. So, USD/JPY is slowly climbing higher but i am thinking of shorting this pair at the resistance level at 107 when the price gets there. The 20 SMA (grey) also stands right there at the moment and it is expected to add some more strength to that resistance area, so waiting for the buyers to take this pair up there.