Forex Signals Brief for Sep 6: Payrolls are Here

It's that time of the month again when we get arguably the biggest economic data point of the month. US non-farm payrolls.

It’s that time of the month again when we get arguably the biggest economic data point around – US non-farm payrolls.

This month’s payroll data comes at a very interesting time. Markets have been grappling with a whole host of global worries, with none bigger than China. The trade wars have been in the back of everyone’s mind for a number of months now, but yesterday, it looked like the Chinese Government decided it wanted to be proactive in discussions and released a statement suggesting as much.

The news sent risk assets flying higher with the SPX in particular rallying strongly. This makes today’s jobs report a little more interesting as well.

Given that the US jobs situation has been a relative stronghold of the economy for a while now, another good result today could send the risk-on trade even higher.

That would mean we could see a sharp jump in things like WTI and the AUD/USD, while GOLD could well be in for some short-term pain.

Yesterday the unofficial ADP number impressed with nearly 200K new jobs created, so the market will be hoping for something similar today. We’ll also hear from the Fed boss late in the US session, just to keep us all on our toes headed into the weekend.

Forex Signal Update

The FX Leaders Team finished with 4 wins from 6 signals in a busy day for the team.

NZD/USD – Active Signal

The NZD/USD has seen some upside over the last couple of sessions, thanks to risk being back in favour. However, price has rallied right into resistance and as was the case yesterday with our EUR/JPY signal, when that happens there is a good chance of a quick retrace.

Gold – Pending Signal

GOLD fell away sharply yesterday, as risk-on was a key theme after the de-escalation in the US-China talks. However, don’t be fooled, Gold is on a bull run still, so this might be a great ‘buy-the-dip’ trade.

Cryptocurrency Update

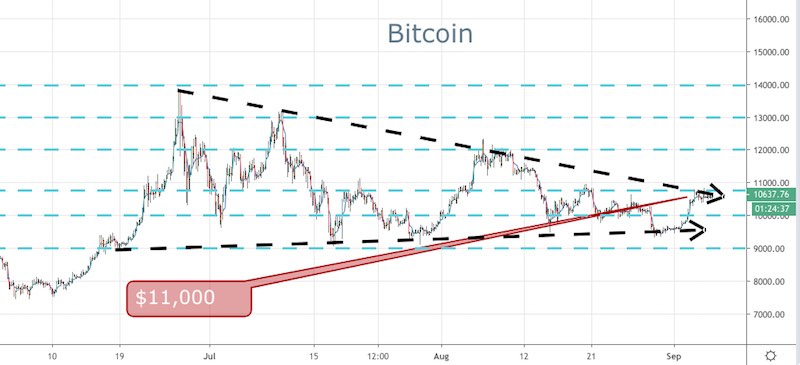

BTC is busy coiling at the moment and I feel it is on the verge of a decent breakout.

Like I mentioned earlier today, price moves from periods of low volatility (contraction) to periods of high volatility (expansion).

So with that in mind, it we are able to break out above $11,000 here, the door would be open for an extended move.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account