Forex Signals US Session Brief, Sep 19 – Not Much Changed After 4 Central Banks

In the last two days we have several major central banks hold meetings and decide on the monetary policy. Central banks have turned pretty dovish recently. many have cut interest rates, with the ECB being the last one to join the club last Thursday when they cut deposit rates to -0.50%. Yesterday was the big day, as markets have been anticipating the FED meeting for quite some time, hence the slow price action in the last few days. The FED cut interest rates as well, which was the second time in the last two meetings, but they didn’t sounded too worried or too dovish. As a result, the USD found some bids after the press conference from Powell, but it is not running anywhere today. So, the situation is pretty much where it was before that meeting and markets are on a wait-and-see mode.

Early this morning, the Reserve bank of Australia (RBA) released their bulletin which was not much different from the previous one, although the AUD has turned bearish today on weaker jobs report and the unemployment rate ticking higher. The Bank of Japan (BOJ) and the Swiss National Bank highlighted the economic weakness and said that they are more inclined to cut rates now than in the previous meeting, but they offered nothing to suggest an actual decision in the coming meetings. This turned the JPY and the CHF slightly bullish, but they have been reversing in the last few hours. The Bank of England also remained on hold as widely anticipated, so Brexit will be the driving force for the GBP.

The European Session

- ECB’s Rehn Sounds Pessimistic on Inflation – ECB governing council member Olli Rehn commented on inflation, saying that the economic data points to muted inflation outlook for a long time. Concerned about impact of global slowdown on the euro area. ECB is providing substantial monetary stimulus.

- SNB Meeting – The SNB left the policy rate unchanged at -0.75% against -0.75% forecast. SNB rate is steady at -0.75% but they said they are willing to intervene in the foreign exchange market as necessary while taking the overall currency situation into consideration. But, the market was expecting something stronger from them today, so the CHF turned bullish after that.

- UK Retail Sales – The retail sales report was released this morning. Sales turned negative again in August, declining by 0.2% MoM as expected. July sales were revised higher though, from 0.2% to 0.4% MoM. Retail sales YoY came at 2.7% against 2.8% expected. Prior sales YoY stood at 3.3% but were revised higher to 3.4%. Core retail sales, excluding autos and fuel, came at -0.3% MoM against -0.3% expected. Core sales YoY, excluding autos and fuel, came at 2.2% vs 2.3% expected. Prior stood at 2.9% but was revised higher to 3.1%. Weaker sales in August, but July’s revisions higher balance things out somewhat.

- BOE Meeting – The BOE left interest rates unchanged at 0.75% again as expected. Official bank rate votes came in at 0-0-9 against 0-0-9 expected. Asset purchase target also remained unchanged at £435 billion. Corporate bond target at £10 billion. Asset purchase target also remained unchanged at £435 billion. Corporate bond target at £10 billion. Statement notes: If Brexit uncertainty persists, inflation likely to become weaker. Inflation will stay under 2% target for the rest of 2019 based on staff forecasts. Labour market appears to remain tight, too early to judge that it is starting to loosen. BOE sees Q3 economic growth at 0.2% down from 0.3% previously. So, no technical recession it seems. Nothing new from the BOE, apart from the slightly revision down for GDP growth for Q3 and the GBP is unfazed.

- Iran’s Zaganeh Feels Confident on Oil Markets – Iranian oil minister Bijan Namdar Zanganeh made a couple comments on Oil earlier today. He said that the balance in oil markets will be restored “soon”. Oil is not a weapon but the US is using it as one.

The US Session

- Trump is Keeping Powell on the Job – The US President Donald Trump was speaking to Fox News a while ago, saying that he is not thrilled with the Fed, but Powell’s job is safe. Powell doesn’t know how to play the game very well, the FED has raised rates too fast. The FED should cut more, as other central banks will do so.

- Canadian ADP Employment – The Canadian August ADP employment came in at 49.3K. The July number stood at 73.7K but was revised lower to 30.2K. Trade/transport and utilities accounted for 17.9K jobs, education and healthcare for 15.2K, manufacturing for 4.5K jobs, while natural resources and mining lost jobs, posting a -5.1K decline for last month.

- Philly FED Manufacturing Index – The manufacturing sector has been weakening in the US as well recently, joining the rest of the globe. Although, it is not in contraction yet and today’s Philly FED manufacturing Index beat expectations, coming at 12.0 points against 10.9 points expected. The employment index came at 15.8 points versus 3.6 last month, new orders declined slightly to 24.8 points from 25.8 last month, prices paid made a big jump to 33.0 points versus 12.8 last month. This is the highest since December 2018. Prices received also increased to 20.8 points versus 13.0 last month. This is the highest since March.

Trades in Sight

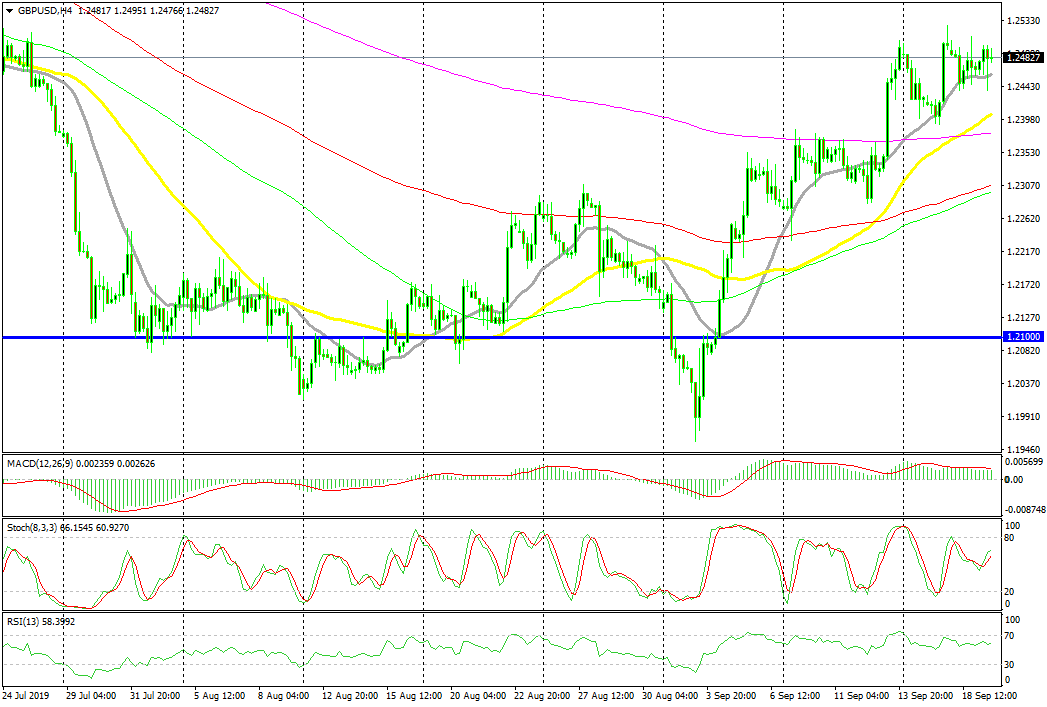

Bullish [[GBP/USD]]

- The trend is bullish on the H4 chart

- The 20 SMA is pushing the price higher

- Fundamentals point up

GBP/USD continues to be bullish

GBP/USD turned bullish at the beginning of this month on some increased USD weakness and on rumours that Brexit might be extended once more at the end of October. Moving averages have been helping it climb higher and this week it has been the 20 SMA (grey) which has been providing support and pushing the price higher. Earlier we saw a decline to the 20 SMA ahead of the BOE meeting, but the price bounced off that moving average after the BOE left things as they were. So, the pressure is to the upside for this pair.

In Conclusion

The FED cut interest rates for the second time in the last two meeting yesterday, which seems to have pleased Donald Trump to some degree. Powell was as good as gone until yesterday, but now Trump might give him another mandate when the current one ends, as he suggested a while ago today.