Getting Ready to Sell EUR/GBP as it Retraces Higher

EUR/GBP has been really bearish in the last two weeks after reversing above 0.90. This pair has lost around 450 pips from top to bottom, as the GBP keeps climbing up on Brexit hopes. The Euro has benefited from this as well because an orderly Brexit will mean one less issue for the Eurozone economy; but the climb in the GBP has been much stronger, hence the bearish trend in this pair.

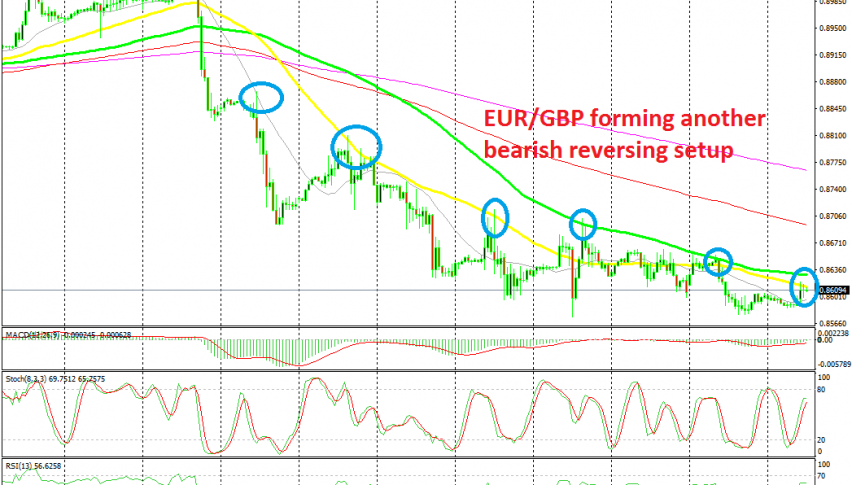

In the first few days, the trend was pretty strong and smaller moving averages such as the 20 SMA (grey) and the 50 SMA (yellow) were providing resistance, as they pushed the price down. As the trend slowed down in the last several days, the 100 SMA (green) caught up with the price and it turned into resistance for EUR/GBP.

Yesterday we saw the 100 SMA reverse the price down once again. This morning the price retraced higher and right now EUR/GBP is finding resistance at the 50 SMA. The retrace higher is almost complete as the stochastic indicator shows on the H1 chart and the last candlestick closed as a doji, which is a reversing signal. So, we decided to sell this pullback since the chart setup points to a bearish reversal soon. The 100 SMA also stands around 15 pips higher as a protection for us, just in case sellers push the price higher.