Forex Signals US Session Brief, Oct 25 – Slow Price Action as Uncertainty Prevails Again

This year, the sentiment in financial markets has been mostly negative, which can be observed by the surge in Gold and the decline in Crude Oil prices, due to an escalating trade war and a weakening global economy. But, this month the situation improved considerably as US and China reached a partial trade deal and Boris Johnson stuck a Brexit deal with the EU. Although, the political situation in the UK doesn’t seem to be stable now and the uncertainty is prevailing in financial markets again.

The UK opposition has been pushing for general elections and Boris Johnson seems to agree now, after losing the meaningful vote on the British Parliament. But, that’s not very clear either. The EU is deciding whether to grant another Brexit extension to the UK, which they likely will, but they are waiting to see what Britain will decide regarding elections. As a result, the sentiment has been slightly negative today, with safe havens climbing higher and risk assets slipping lower, albeit pretty slowly.

The European Session

- China Not Pleased With Pence – Mike Pence made some comments earlier about China not doing its part to normalize trade relations, accusing it for unfair trade practices. China doesn’t seem happy about that as Chinese foreign ministry said that Mike Pence made irresponsible comments about China. They are extremely indignant about Pence’s speech and resolutely opposes it. China’s development is not a threat to anyone, they ended it.

- German Ifo Business Climate – The business climate has been deteriorating in Germany this year, as the manufacturing sector fell deeper into recession. Ifo business climate fell to 94.6 points last month and it was expected to tick lower to 94.5 points today, but it remained unchanged. GfK consumer climate has also been weakening, falling to 9.6 points today, against remaining unchanged at 9.8 points expected.

- UK Finance Minister Speaking on Brexit – Sajid Javid was speaking early this morning, saying that if the Labour Party doesn’t support an election, we will bring the vote to the parliament again and again. He added that the government cannot take no-deal Brexit off the table.

- No Fiscal Stimulus From Germany Despit Draghi’s Call – Yesterday we heard ECB president Mario Draghi ask for Eurozone governments to increase fiscal stimulus to help the economy. But, German government spokesperson Ulrike Demmer said that there is no need for fiscal stimulus package. Germany is sticking to balanced budget policy.

- EU Grants Brexit Extension But Gives No Date – The EU27 have agreed in principle on Brexit extension but no date set yet. There was full agreement on the need for a Brexit extension. They are to meet again early next week to finalize an agreement.

The US Session

- BoJo Speaking on Brexit and Elections – UK prime minister Boris Johnson commented a while ago that if Labour Party opposes election, we will not engage in pointless “Brexitology” in parliament. The government will continue with domestic agenda. It is up to the EU to decide on extension, we can leave on 31 October. Johnson reaffirmed that he is “totally against” Brexit extension.

- ECB’s Vasiliuskas Doesn’t See More Rate Cuts – ECB member Vitas Vasiliauskas said today that he doesn’t think we need any big policy changes right now. Some divergence of views within the ECB is expected. September package was to act in a preventive manner.

- US Markit Flash Manufacturing PMI – This manufacturing indicator has been performing better than ISM manufacturing lately. It got pretty close to stagnation in August, but last month it moved higher to 51.1 points. This month, the manufacturing PMI was expected to cool off again and fall to 50.7 points, but it moved higher to 51.5 points.

Trades in Sight

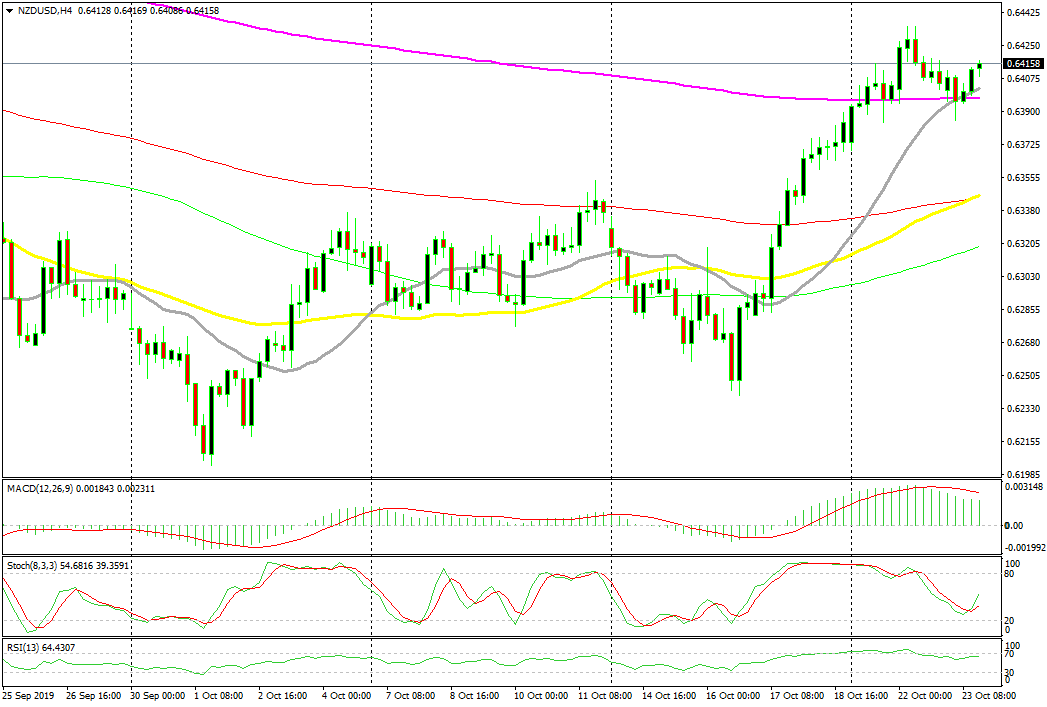

Bullish NZD/USD Again

- The trend has turned bullish in the last week

- MAs are providing support

- The retrace lower is complete on the H4 chart

The 20 and the 200 SMAs have acted as support for NZD/USD on the H4 chart

NZD/USD has turned pretty bullish in the last week or so. The market sentiment has improved, which helps risk currencies, while the USD has turned pretty soft recently as the FED turned dovish, cutting interest rates twice and preparing for another cut later this month. During the uptrend, the price has been finding solid support at the 20 SMA (grey) on the H1 chart, but today it found support at this moving average and the 200 SMA (purple) on the H4 chart. Now the retrace is over as stochastic is turning upwards and the price is bouncing off those moving averages.

In Conclusion

Hopes for an economic rebound in the Eurozone which increased after the services and manufacturing figures from France, dissipated after the German and Eurozone reports were released. US Markit manufacturing PMI also came in higher today, but the decline in durable goods orders will affect this sector in the coming months.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account