Crude Oil was very bullish in December, after OPEC+ decided to curb production further, by placing quotas on an additional 50k barrels/day. The improving sentiment due to the Phase One trade deal between US and China helped push risk assets such as Crude Oil higher, with US WTI climbing above $65.

But, the sentiment turned negative as the coronavirus broke out in China and risk assets turned bearish earlier this month. They have been quite bearish since then and moving averages have turned from support into resistance for US Oil, which shows that the situation has turned quite bearish.

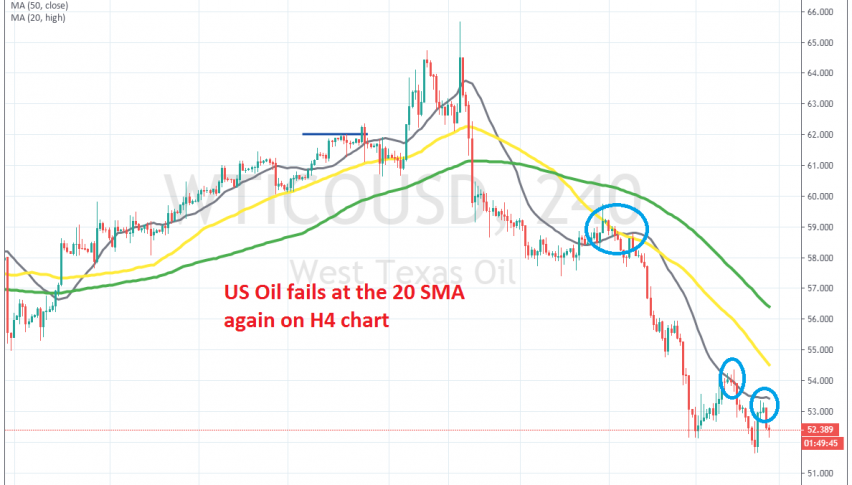

The 50 SMA (yellow) turned into resistance first, reversing the price down after a slight pullback. Earlier this week, we saw another retrace higher, but this time it was the 20 SMA (grey) which took up that job. The price formed a few reversing candlesticks at that moving average, so we decided to open a long term sell signal, booking around 140 pips, as the price reversed back down.

Overnight, US Oil retraced higher, but the 20 SMA stopped the climb once again, US Oil has reversed back down now and lost around 100 pips, although we missed this opportunity. So, Crude Oil remains bearish as long as the coronavirus looms over our heads, so if we see another pullback higher to moving averages, then we will try to short Oil again.