Bearish Marabou in USD/JPY – Good time to Sell?

USD/JPY surged 2.7% to 111.32 before easing to 109 zones, recouping most of its decline from late February. The latest coronavirus updates reported widespread outbreak in the UK and Italy. In contrast, the news of Gilead’s Remdesivir medicine being tested to cure Covid-19 left a little positive impact on the trading sentiment.

Consequently, the S&P 500 and Dow Jones futures are declining nearly 0.50% by press time. Now it’s going to be interesting to see if the pair can attract any dip-buying at lower levels or continues with its retracement slide due to absent relevant market moving economic releases. Overall, the safe haven appeal of the Japanese yen is getting diminished as traders’ focus stays on the US dollar, which is currently being treated as a safe haven asset. As a result, USD/JPY pair is trading bullish.

Daily Support and Resistance

S1 105.08

S2 107.59

S3 109.24

Pivot Point 110.1

R1 111.75

R2 112.61

R3 115.13

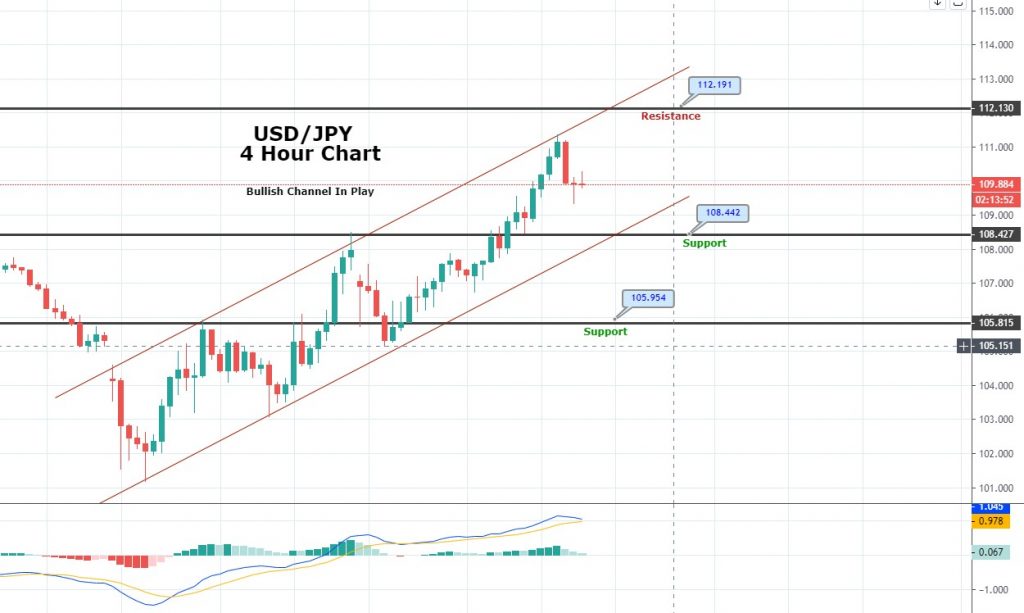

On the technical side, []USD/JPY]] is trading at 109.945 and has recently closed a bearish marabou candle, which is suggesting odds of further selling in the currency pair. On the 4-hour chart, it has formed a bullish channel, which is likely to support the pair around 108.450, while resistance can be found around 111.

The MACD is forming bullish histrogram, which is becoming smaller than the previous one. It signifies that the odds of further selling remains strong below 110 today. So, the idea is to open a sell trade below 110 to target 109 and 108.65. Good luck!