EUR/CHF Bounces Off the 50 SMA But Retreats Back Down

EUR/CHF has been on a bearish trend for a long time, as the trade war between US and China kept the sentiment subdued in financial markets. This has been keeping safe havens such as the CHF climbing, hence the 2-year downtrend in this pair.

But, on Monday last week we saw a 150 pip jump higher, after Merkel and Macron spoke of a coronavirus recovery plan for Europe. But, the main reason for the jump should be intervention by the Swiss National Bank (SNB). They do this thing often, in order to keep the CHF in check.

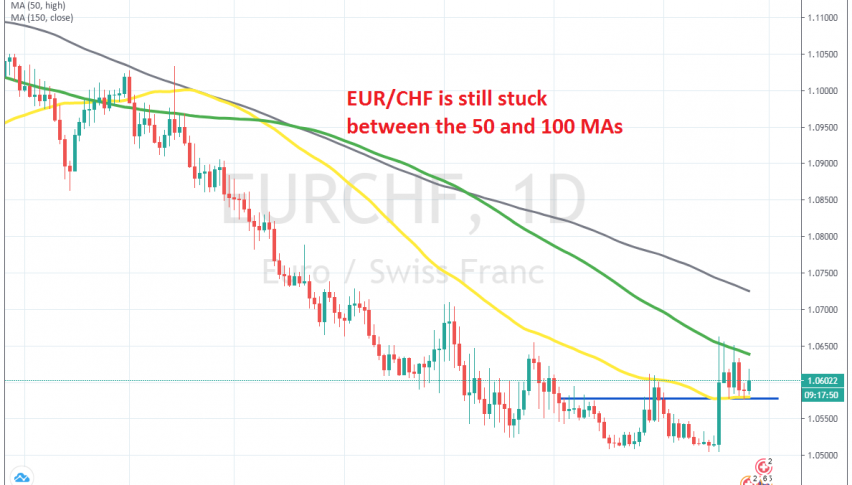

The price broke above the 50 SMA (yellow) on the daily chart at last, but the 100 SMA turned into resistance now. Although, the 50 SMA has turned into support, holding EUR/CHF a few times since early last week. Yesterday, this pair failed to move below the 50 SMA again and the price formed doji candlestick, which is a bullish reversing signal. Today we saw a bullish move higher, but the price failed to reach our take profit target by a mere pip. Although, the daily candlestick still looks bullish, so we will hold on to this trade.