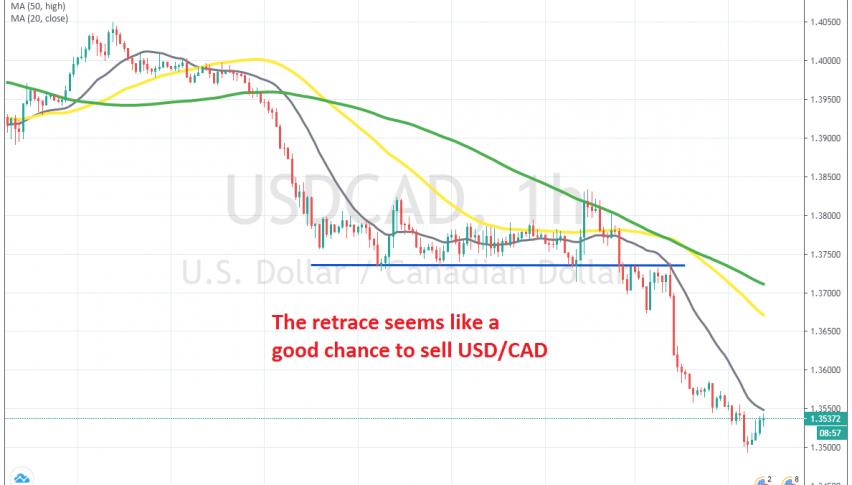

Selling the Retrace in USD/CAD at the 20 SMA

USD/CAD has retraced higher in the last few hours, but the retrace might be complete soon

[[USD/CAD]] turned quite bullish in March, as the coronavirus spread, hurting the risk sentiment and sending the USD surging higher. Crude Oil was also falling during that time and the CAD is closely correlated to Oil prices, so USD/CAD surged around 15 cents higher to 1.47.

But the climb stopped and in the last week of March, USD/CAD retreated lower, giving back some of the gains. In the last two months, this pair put a bottom in place at around 1.3850, while the highs were getting lower, which meant that a wedge was forming on the daily chart.

That wedge was broken by the end of May and USD/CAD made some new lows. This week, USD/CAD lost around 250 pips as the bearish momentum resumed due to the USD weakness and the climb in crude Oil prices. In the last few hours though, we have been seeing a pullback higher on the H1 chart, but the 20 SMA (grey) seems ready to provide resistance above, so this looks like a good chance to sell USD/CAD.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account