GOLD has been bullish throughout this year, with the sentiment in financial markets being negative, turning traders to safe havens. As a result, Gold has climbed more than $350. During the second half of May, we saw a consolidation amid the uncertainty, but the uptrend resumed again in June.

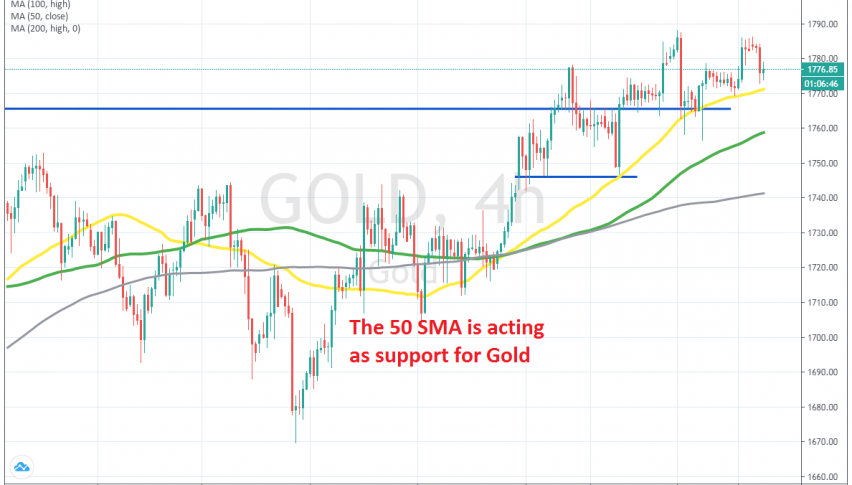

The price moved above moving averages on the H4 time-frame chart and reached $1,778, making new highs in the first day of this month. But, we saw a pullback down back then, which ended at the 50 SMA (yellow). That moving average was pierced a couple of times, but the candlesticks didn’t close below it, so there was no break.

That was the second time the 50 SMA provided support in recent months, after doing so at the end of June. So, this moving average has been acting as support for Gold. Today we are seeing another pullback lower, after the four doji/hammer candlesticks, which are reversing signals. But, sellers are already having second thoughts now, so it seems like the 50 SMA is acting as a support again. Should we buy Gold from here? If we get a bullish reversing candlestick, then we might open a bus forex signal here.