UK Construction Cools Off Again in August

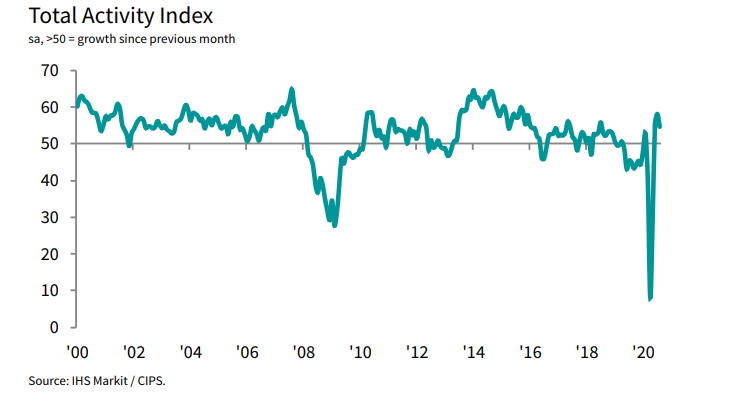

Together with services, the construction sector is one of the most important in the UK. But in April, it dived to the lowest level ever, falling further than any other sector, at 8 points, with 50 being the break-even. But, construction is quite resilient, and it bounced back up as the country reopened, climbing to 58.1 points in July, which is impressive, even for normal times.

Today’s report was expected to show another increase for August, but we saw a reversal down and the Bank of England is thinking about more monetary easing if the weakness increases. Below, you will find the construction report and some comments by the BOE:

UK August Construction PMI

- August construction PMI 54.6 points vs 58.3 expected

- July construction PMI was 58.1 points

The recovery in the UK construction sector slowed a little in August, with civil engineering work slumping back into contraction territory, while both commercial and home building activity lost impetus, as the rebound lost some momentum. The bright side is that business expectations continued to improve, rising to a six-month high, but it remains to be seen how well such optimism can hold up, as we move towards the end of the government’s furlough program and the Brexit closure.

Markit notes that:“The latest PMI data signalled a setback for the UK construction sector, as the speed of recovery lost momentum for the first time since the reopening phase began in May. House building remained the best-performing area of construction activity, with strong growth helping to offset some of the weakness seen in commercial work and civil engineering activity. The main reason for the slowdown in total construction output growth was a reduced degree of catch-up on delayed projects and subsequent shortages of new work to replace completed contracts in August.

“Another month of widespread job-shedding highlighted the ongoing difficulties faced by UK construction companies, with order books often depleted, due to a slump in demand from sectors of the economy that have experienced the greatest impact from the pandemic.

“More positively for the employment outlook, business expectations climbed to a six-month high in August, as construction firms turned their hopes towards a boost from major infrastructure work and reoriented their sales focus on new areas of growth in the coming 12 months.”

Comments by BOE policymaker, Michael Saunders

- Rebound in activity appears to be a bit faster than predicted in the May forecast

- But the rebound has reflected a benign window, which may be closing now

- Unemployment is likely to rise significantly in coming quarters

- Risks lie on the side of a slower recovery over the next year or two

- And a longer period of excess supply may materialize, than in the August forecast

- If these risks develop, then further easing may be needed