US Economy Keeps Progressing, As Employment Report Also Indicates

The US economy took a hit during the height of the pandemic, but it bounced back up when it reopened and continues to expand with a nice pace, unlike in Europe where the economy is slowing down again. We have seen many economic indicators in the last few months which have been impressive.

Manufacturing, services and now employment and earnings are all increasing, while in Europe everything is slowing. The USD has turned bullish again now, but let’s see if it will keep the momentum going.

Highlights of the August 2020 non-farm payrolls report:

- August non-farm payrolls +1371K vs +1350K expected

- Prior was +1763 (revised to 1734K)

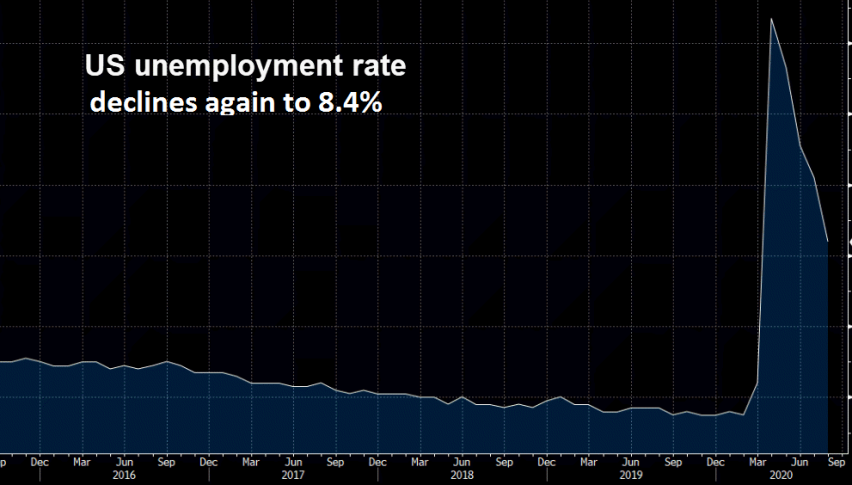

- Unemployment rate 8.4% vs 9.8% expected

- Prior unemployment rate 10.2%

- Unemployment would be 9.1% without misclassification vs 11.1% prior

- Participation rate 61.7% vs 61.8% expected

- Prior participation rate 61.4%

- Underemployment rate 14.2% vs 16.5% prior

- Average hourly earnings 0.0% m/m vs 0.0% expected

- Average hourly earnings 4.7% y/y vs +4.5% expected

- Average weekly hours 34.6 vs 34.5 expected

- Two month net revision -39K

- Change in private payrolls +1027K vs +1325K expected

- Change in manufacturing payrolls +29K vs +65K expected

The headline was pushed higher by government jobs as private employment disappointed but the big story here is the dramatic drop in unemployment. The market reaction has been tepid. USD/JPY initially jumped 25 pips but has halved that while the other dollar moves are smaller. Stock futures are doing a bit better.

Whenever there is a data point like this in a tumultuous market, some of the orderflow goes on pause ahead of the event. So often what looks like the ‘reaction’ is a resumption of people doing what they were going to do before. That can change if the report is wildly out of line but this one is close enough to consensus, and the unemployment drop is some very good news.

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Related Articles

Comments

Subscribe

Login

0 Comments