More Good News From the US, As Fundamentals Keep Improving, But the USD Awaits the Stimulus

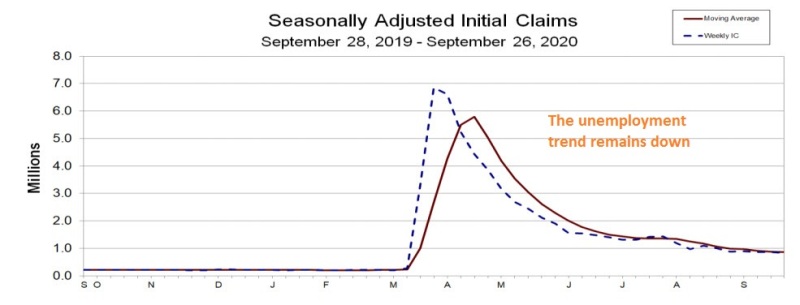

US unemployment claims posted a decline today

The fundamentals in the US keep reinforcing the idea that the US economic recovery is going pretty well, unlike in Europe where it is stagnating. Employment is declining, as today’s report showed, while manufacturing and services keep growing, a well as inflation.

This should be positive for the US Dollar, which should run higher, particularly against the Euro, but traders are concentrated on the US stimulus package, which might or might not pass. So, EUR/USD is still bullish, despite the divergence between the US and European economies, in favour of the former.

US initial jobless claims and continuing claims

- Initial jobless claims 837K vs. 850K estimate

- Prior report revised to 873K from 870K previously reported

- US initial jobless claims 837K vs 850K estimat

- 4 week moving average of initial jobless claims 867.25K vs 879K (was 878.25K)

- Continuing claims 11767K vs 12200K est.

- 4 week moving average of continuing claims 12701.25K vs 13082.5K (was 13040.75)

“California has announced a two week pause in its processing of initial claims for unemployment insurance benefits. The state will use this time to reduce its claims processing backlog and implement fraud prevention technology. Recognizing that the pause will likely result in significant week to week swings in initial claims for California and the nation unrelated to any changes in economic conditions, California’s initial claims published in the UI Claims News Release will reflect the level reported during the last week prior to the pause. Upon completion of the pause and the post-pause processing, the state will submit revised reports to reflect claims in the week during which they were filed.”

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account