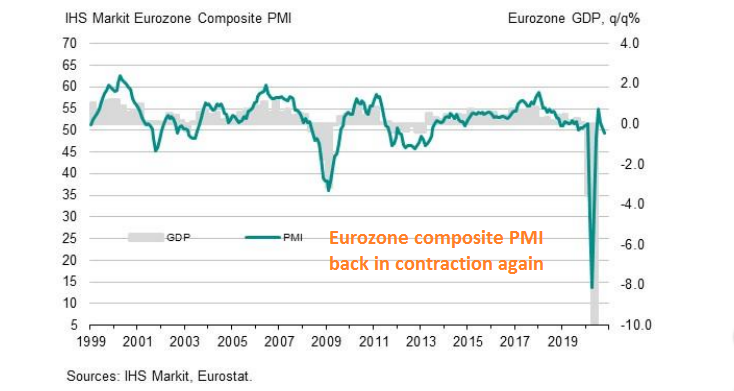

Services Dive Further Into Contraction in Europe

Eurozone services continue to contract in October again

The economic situation is reversing back in Europe. The economy started bouncing well after the reopening in Spring, but it started softening again in Summer and it seems like services are back in contraction now. They fell below 50 points in September, while today’s report showed a further dip in contraction, which will turn into recession for this sector, although manufacturing is still expanding. So, this dip in services is coming from the coronavirus measures once again, although the Euro didn’t mind much, as EUR/USD remains bullish today.

Latest data released by Markit – 23 October 2020

- October flash manufacturing PMI 54.4 points vs 53.0 expected

- September flash manufacturing PMI was 53.7 points

- Services PMI October 46.2 points against 47.0 expected

- Services PMI in September was 48.0 points

- Composite PMI October at 49.4 points vs 49.2 expected

- Prior composite PMI was 50.4 points

“The eurozone is at increased risk of falling into a double-dip downturn as a second wave of virus infections led to a renewed fall in business activity in October.

“The survey revealed a tale of two economies, with manufacturers enjoying the fastest growth since early-2018 as orders surged higher amid rising global demand, but intensifying COVID-19 restrictions took an increasing toll on the services sector, led by weakening demand in the hard-hit hospitality industry.

“The divergence is even starker by country. While Germany is buoyed by its manufacturing sector booming to a degree exceeded only twice in almost 25 years of survey history, the rest of the region has sunk into a deepening downturn.

“While the overall downturn remains only modest, and far slighter than seen during the second quarter, the prospect of a slide back into recession will exert greater pressure on the ECB to add more stimulus and for national governments to help cushion the impact of COVID-19 containment measures, which not only tightened across the region in October but look set to be stepped up further in November.”

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account