⚡Crypto Alert : Altcoins are up 28% in just last month! Unlock gains and start trading now - Click Here

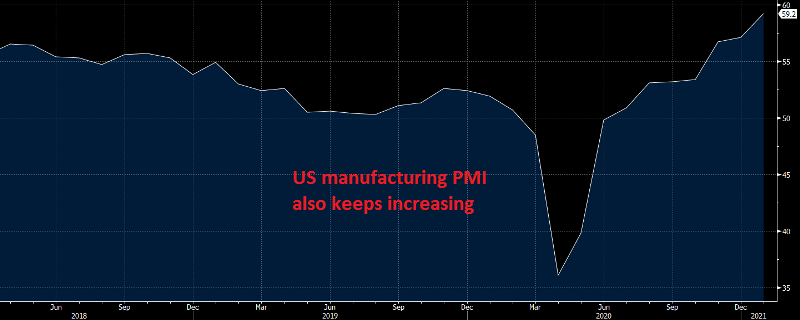

US Manufacturing Activity Keeps the Extraordinary Pace

Manufacturing has been in quite a good shape everywhere during this second round of coronavirus restrictions, as we saw in Europe earlier today. Although, in the US manufacturing has been absolutely surging in the last few months. ISM manufacturing indicator moved higher to 60.7 points in December, while today it was expected to cool off a bit to 60.0 points. It cooled of a tad, but still remains at very decent levels.

US ISM January Manufacturing Report

- ISM January US manufacturing PMI 58.7 vs 60.0 expected

- Prior was 60.5

- Prices paid 82.1 vs 77.6 prior (highest since 2011)

- New orders 61.1 vs 67.5 prior

- Employment 52.6 vs 51.7 prior

- Full report

Comments in the report:

- “Supplier factory capacity is well utilized. Increased demand, labor constraints and upstream supply delays are pushing lead times. This is more prevalent with international than U.S.-based suppliers.” (Computer & Electronic Products)

- “Business remains strong. Manufacturing running at full capacity.” (Chemical Products)

- “Very strong demand with limitations in supply to meet increased demand.” (Transportation Equipment)

- “Labor continues to be one of our largest challenges.” (Food, Beverage & Tobacco Products)

- “Our current business demand is going way past pre-COVID-19 [levels].” (Fabricated Metal Products)

- “Business is very good. Customer inventories are low, with a significant order backlog through April. Supply base is struggling to keep up with demand, disrupting our production here and there. Raw material lead times have been extended. COVID-19 continues to cause challenges throughout the supply chain. Huge logistics challenges, especially in getting product through ports and in getting containers. We are seeing significant cost increases in logistics and raw materials.” (Machinery)

- “We have had an increase in employees testing positive for COVID-19, negatively impacting manufacturing.” (Miscellaneous Manufacturing)

- “2020 growth at 5 percent during a very challenging and volatile year. 2021 is expected to bring growth at a 7-percent or even greater pace. Logistics is the critical concern, but we are currently abating risk.” (Electrical Equipment, Appliances & Components)

- “January 2021 started with strong orders for plastic components in auto, electrical and other sectors. The industry outlook is optimistic. Looking at investing in new equipment for anticipated demand later this year. Reshoring is taking hold, with new customer potential.” (Plastics & Rubber Products)

- “Business is improving, but we are still struggling with a shortage of available labor.” (Primary Metals)

Those don’t sound like comments from a country in a pandemic and with more people unemployed than the peak of the financial crisis. These are strange times.

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Related Articles

Comments

Subscribe

Login

0 Comments