The Second Reading Confirms the Jump in Eurozone Inflation

Inflation cooled off last year everywhere, due to the falling oil prices, which turned negative in spring. Oil prices reversed higher, but inflation continued to weaken in Europe, due to the coronavirus restrictions. The Eurozone CPI (consumer price index) turned negative in August and it remained at -0.3% until December.

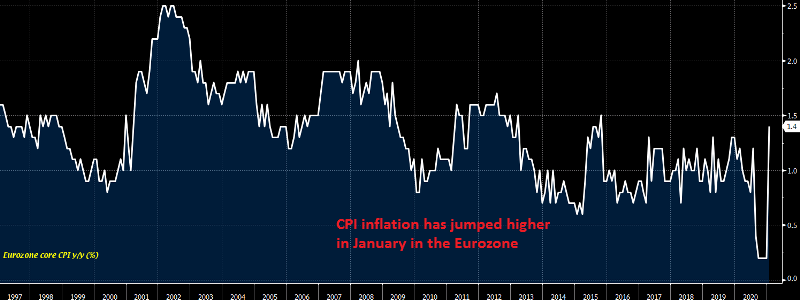

But in January, we saw a jump in headline CPI, which increased by 0.9%, while the core CPI increased by 1.4%. It seemed a bit strange, but the new year has refreshed the history and today’s second CPI reading confirmed the jump for January. Below is the CPI report:

Eurozone January CPI Report

- January CPI YoY +0.9% vs +0.9% expected

- December CPI YoY was -0.3%

- Core CPI YoY +1.4% vs +1.4% expected

- December core CPI was +0.2%

The core reading jumped to its highest level in five years as the figures here beat estimates quite handily, surprisingly to the upside. That said, things must be put into context. This shouldn’t change a thing in terms of the ECB outlook, as the jump in inflation is due to a host of special circumstances that kicked off the year. In any case, we can expect more volatility in the numbers to follow in the coming months as well.