Will We See A Retreat in Bitcoin Before Moving Above $60,000 Again?

Bitcoin went through one of the biggest retreats since early 2008, after the massive surge that year. This time the surge has continued for months and the retreats haven’t been as catastrophic as back then, so the bullish trend continues.

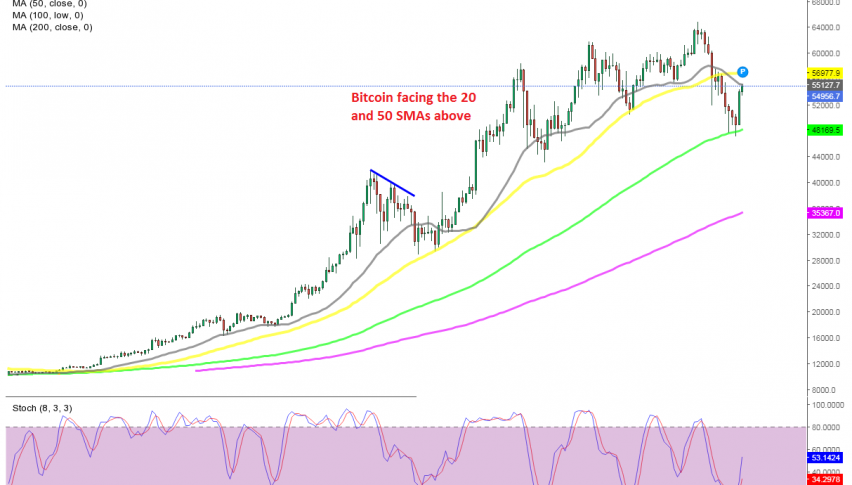

Although, last week set the price nearly $20,000 back, as BITCOIN lost around 25% of its value. BTC/USD fell below the 20 SMA (gray) and the 50 SMA (yellow) for the first time since October last year, but it found solid support at the 100 SMA (green) on the daily chart.

Sellers briefly pushed below that moving average on Sunday, but the price pulled back up and the daily candlestick closed above the 100 SMA, so there was no official break. Yesterday, the price bounced off the 100 SMA and Bitcoin is $8,000 higher now, trading around $55,000.

Although, the 20 SMA is turning into resistance now, after the climb has stalled right at this moving averages. If the 20 SMA goes, then the 50 SMA (yellow) will come back into play, this time as a resistance indicator instead.

So, Bitcoin has some obstacles above and there is a chance that we might see another pullback lower, probably to $50,000 or below before the next assault to the upside. Although, the 20 SMA or the 50 SMA will have to act as resistance and reverse the price down. We are following the price action and will try to buy Bitcoin if we see it retreating back down towards $50,000.