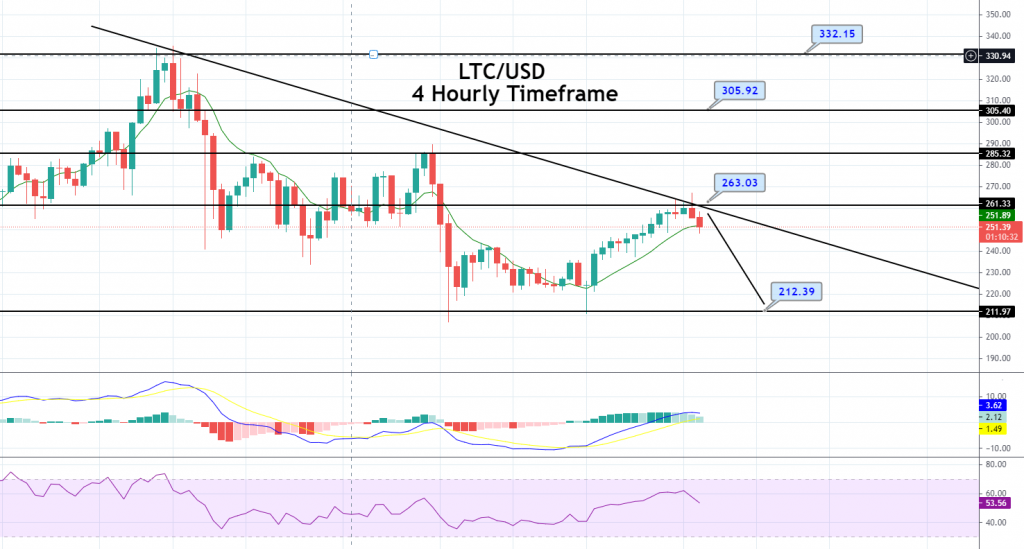

Litecoin Price Forecast – Downward Trendline Resistance, Brace for Sell!

LTC/USD closed at 259.830 after placing a high of 263.067 and a low of 243.842. After declining continuously for nine consecutive sessions

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

LTC/USD closed at 259.830 after placing a high of 263.067 and a low of 243.842. After declining continuously for nine consecutive sessions, Litecoin posted the second day of gains on Tuesday. The recent spike likely followed the upward momentum in Bitcoin prices. BITCOIN remained on a positive note for the second day in the market amid a stockpile of positive news.

First, another U.S. bank – Bancorp, the fifth-largest in the country, announced to provide Bitcoin and other cryptocurrency exposure to its customers on increased demand from them. Second, Mastercard and Gemini also announced a new reward system for credit cards that are expected to pay cashback to its users in Bitcoin by almost 3%. Third, the company owned by billionaire Elon Musk, Tesla, reported record profits due to sales of emissions credits and speculative gains on Bitcoin. The rising prices of Bitcoin changed the market mood to bullish, and other altcoins like LTC/USD also followed it and increased their gains.

LTC/USD Daily Technical levels

Support resistance

251.551 263.927

243.300 268.052

239.175 276.303

Pivot Point: 255.676

The LTC/USD pair is trading at 251 level, taking a bearish turn below a strong resistance area of 263. On the lower side, the pair has closed a shooting star candle that’s suggesting odds of bearish trend continuation. On the lower side, LTC can gain support around 230 and 212 levels. The MACD value is holding above 0 levels, but the recent histograms suggest bearish bias in the pair. At the same time, the pair is also crossing below 50 EMA on a 4-hour chart. Let’s consider taking a sell trade below 262 level today. Good luck!

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account